Finding life insurance after kidney cancer can feel overwhelming, but it doesn’t have to be. The truth? You can get coverage. You just need to understand how life insurance companies view kidney cancer and how to apply for coverage.

At RiskQuoter, we work with high-risk life insurance companies that specialize in kidney cancer and know how to underwrite your medical history. We offer all types of life insurance policies to get you the coverage you deserve at an affordable rate.

Understanding Kidney Cancer and Life Insurance

Finding life insurance after a cancer diagnosis can be challenging, but we show you how to get approved.

Every year, more than 50,000 people in the U.S. are diagnosed with kidney cancer, with 90% being renal cell carcinoma (RCC).

There are several subtypes of renal cell cancer, including:

- Clear Cell Renal Cell Carcinoma (most common type)

- Non-Clear Renal Cell Carcinoma (and its subtypes)

- Papillary renal cell carcinoma

- Chromophobe renal cell carcinoma

Other types of kidney cancer include:

- Transitional Cell Carcinoma

- Renal Sarcoma

- Wilms’ tumor (nephroblastoma)

It’s important to have your exact diagnosis to provide you with accurate quotes.

Kidney Cancer Risk Factors

Many risk factors may increase the chance of getting kidney cancer, including:

- Excess Body Weight

- High Blood Pressure

- Smoking

- Family History

- Kidney Disease

Other conditions like Cowden syndrome increase the risk of kidney, breast cancer, or thyroid cancer.

What Life Insurance Companies Ask About Your Kidney Cancer

Life insurance underwriters want to know the following about your cancer history:

- Exact cancer type (e.g., renal cell, clear cell, hypernephroma)

- Stage and grade of the cancer (T0-T4, nodal/metastatic status)

- Tumor size

- Treatment Method (Nephrectomy, partial removal, chemo, radiation)

- Date of diagnosis and treatment dates

- Evidence of recurrence?

- Any residual tumors or abnormal follow-ups

- Are your current kidney function tests within normal limits?

- Blood Urea Nitrogen (BUN)

- Creatinine Clearance

- Serum Creatinine

- Other health issues – heart conditions, gastrointestinal problems, diabetes, leukemia, and others.

How Kidney Cancer Stage Affects Life Insurance Rates

The underwriting outcome largely depends on the stage of your cancer and how long it’s been since treatment ended.

Stage T0 or T1 Kidney Cancer

These are early-stage cancers with smaller tumors and no lymph node involvement.

- Postponement Period: 1–2 years after treatment ends

- After Postponement: May qualify for coverage with a flat extra

- Long-Term: Potential to qualify for standard rates after 7–10 years, and some may qualify for preferred rates after 20 years.

Stage T2 and T3 Kidney Cancer

These stages involve larger tumors or more local spread, but no distant metastasis.

- Postponement Period: Usually 3–5 years post-treatment

- After Postponement: Higher flat extra charges (up to $1500 per $100,000)

- Flat extras may last 10 years before standard rates are possible

Real Life Case Study

Our Client – Male, age 45, was diagnosed with stage 2, grade 2 clear cell renal carcinoma at age 40. He had a radical nephrectomy with no further treatment needed.

Most companies had a 10-year postponement period from surgery, but I was able to get him an offer at the 5-year mark with John Hancock.

Like many cancer cases, a flat extra expense was added to the policy for two years, but not a table rating. The flat extra added $700 for every $100,000 of coverage.

He wanted a $1 million policy, but the flat extra would add $7000 to the base premium of $2100 = $9100 per year for the first two years, and then the price would drop to $2100 per year for the remaining 18 years of the policy.

It was too much, so we went with a $500,000 policy which consisted of a flat extra of $3500 ($700 x 5) plus the base premium of $1140 = $4640 per year for two years, and then reduced to $1140 for the rest of the term.

The Bottom Line – Coverage was available, but whenever a flat extra expense is involved, it gets very expensive.

Stage 4 Kidney Cancer

These are advanced cases with more aggressive metastatic progression.

Your traditional term, universal, and whole life insurance policies will not be available.

Guaranteed issue insurance is available, although you should read our article about the downsides of final expense insurance.

Treatment Types and How They Affect Approval

If the entire kidney was removed and margins were clear, you’ll likely have better underwriting results, especially for Stage 1 cancers.

Partial Nephrectomy – Coverage is still available, but the postponement period may be longer.

Chemo or Radiation – Postponement periods start from the date treatment ends.

Lab Results Matter – What Underwriters Look For

To be considered for life insurance, your kidney function must be within normal limits. That includes:

- Creatinine

- BUN (Blood Urea Nitrogen)

- GFR (Glomerular Filtration Rate)

- Urinalysis results

If your lab values are normal and stable, you’re far more likely to be approved.

Top Life Insurance Companies for Kidney Cancer

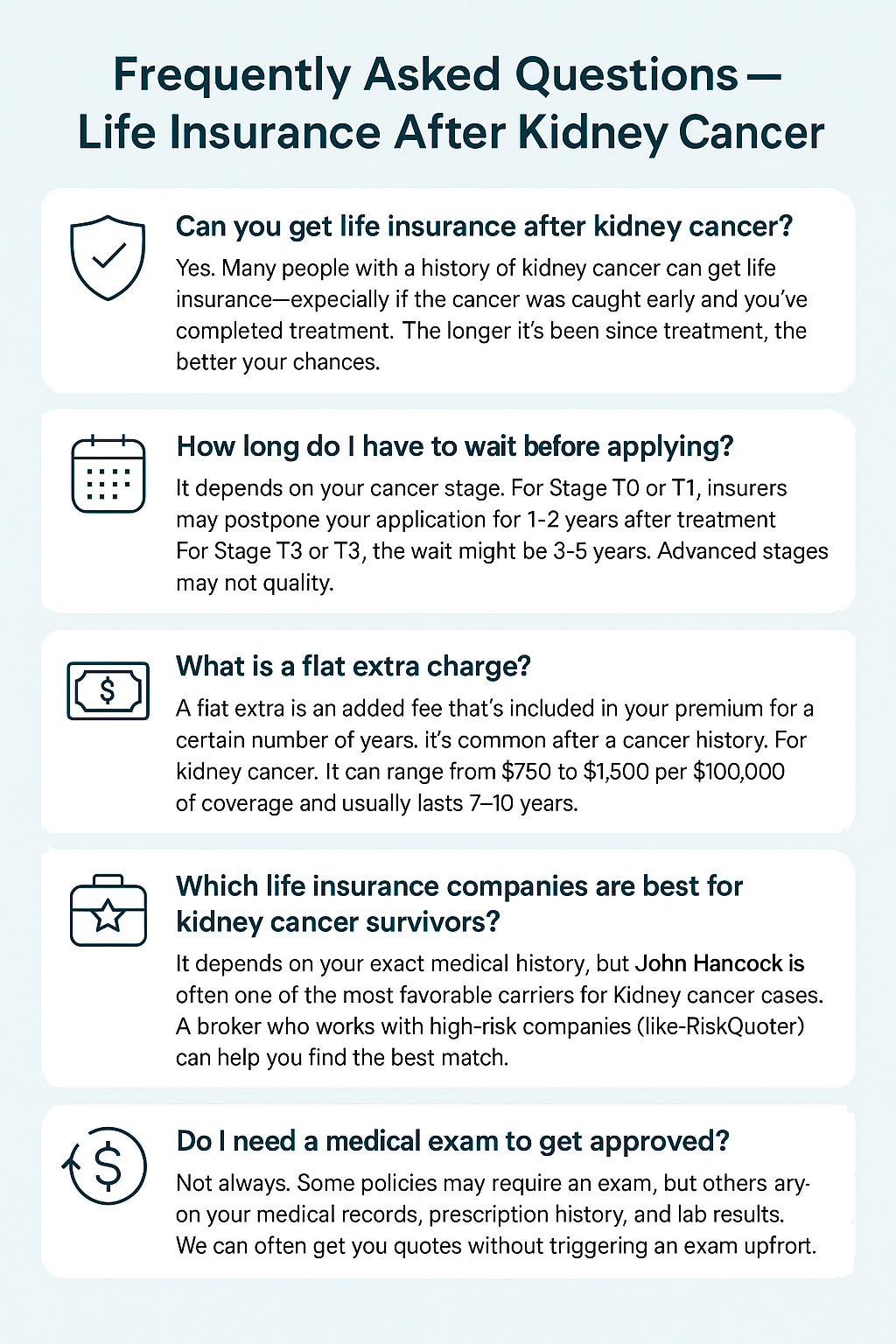

Some carriers underwrite kidney cancer more favorably than others. Based on experience, John Hancock is often one of the most kidney-cancer-friendly companies.

Other companies to consider include Prudential and Lincoln Financial.

Other top choices vary depending on your age, health, and the time since your treatment ended. That’s why shopping around matters.

Here’s how our process works:

- We ask a few questions based on the underwriting criteria shown above.

- We privately shop your case to companies that specialize in cancer risks.

- You’ll have underwriting feedback in about 3 days

- If you like the offer, you apply. If not, no pressure.

FAQ

Yes. Many people with a history of kidney cancer can get life insurance, especially if the cancer was caught early and you’ve completed treatment. The longer it’s been since treatment, the better your chances.

It depends on your cancer stage. For Stage T0 or T1, insurers may postpone your application for 1–2 years after treatment. For Stage T2 or T3, the wait might be 3–5 years. Advanced stages may not qualify.

A flat extra is an additional fee that is included in your premium for a specified number of years. It’s common after a history of cancer. For kidney cancer, it can range from $750 to $1,500 per $100,000 of coverage and usually lasts 7–10 years.

Final Words

Yes, you can obtain life insurance after being diagnosed with kidney cancer. But not every company will treat you the same way.

At RiskQuoter, we’ll show you who’s most likely to approve you—and at what price—before you ever apply.

Let’s talk about your options. There’s no pressure and no obligation—just straight answers.

Thank you.

Sources