When you have diabetes, life insurance is a crucial part of your financial plan. Without it, your loved ones could face a financial burden.

The good news? Most people with diabetes can be approved for all types of life insurance, including term life insurance, whole life insurance, universal life insurance, and guaranteed issue policies.

- Understanding Life Insurance for Diabetics

- Getting Life Insurance with Type 1 Diabetes

- Getting Life Insurance with Type 2 Diabetes

- How Much Does Life Insurance Cost with Diabetes

- Gestational Diabetes Life Insurance

- How Diabetes Control & Management Impacts Life Insurance

- Diabetes and Other Health Issues – How They Affect Life Insurance

- Specialty Programs for Diabetes

- What to Expect During The Underwriting Process for Diabetes

- Frequently Asked Questions About Diabetes and Life Insurance

- Top 5 Life Insurance Tips for Diabetics

- FAQ

Understanding Life Insurance for Diabetics

You might think getting life insurance with diabetes is impossible or unaffordable. However, many life insurance companies specialize in underwriting for people with diabetes.

Finding the best life insurance companies for diabetics depends on several factors:

- Type of diabetes (Type 1, Type 2, Gestational)

- Age of diagnosis and duration of having diabetes

- Diabetic control history (A1c, blood glucose levels, etc.)

- Compliance with treatment (regular endocrinologist visits, medication adherence)

- Medications and dosages – What do you take, how much, and how often?

- Diabetes complications – Neuropathy, retinopathy, insulin shock, coma.

- Other health issues (especially heart and kidney conditions.

You might pay more than someone without a high-risk medical condition, but finding affordable life insurance for diabetes is achievable with our help.

Getting Life Insurance with Type 1 Diabetes

Type one diabetes mellitus is a chronic auto-immune condition that requires lifelong insulin therapy.

Life insurance for type 1 diabetes tends to be more expensive due to the progressive nature of diabetes and the higher risks involved than for type 2.

However, life insurers like AGI, Corebridge Financial, John Hancock, and Prudential1 are known for offering coverage to people with Type 1 diabetes.

How do we know which life insurance company will be best for your medical history?

We use a quick quote process where we summarize your medical history and get underwriting feedback from all companies specializing in diabetes.

Getting Life Insurance with Type 2 Diabetes

Type 2 diabetes is a metabolic condition where the body does not produce enough insulin. Type 2 is often managed through diet, exercise, medication, and lifestyle changes.

Several factors contribute to a type 2 diabetes diagnosis, including:

- Genetics

- Being overweight

- Lack of exercise

- Older than age 45

- Family history of diabetes

- Gestational diabetes during pregnancy

- Having prediabetes or metabolic syndrome

Life insurance companies want to see:

- Improvements to your glucose control

- Weight loss

- Increased exercise

- Cholesterol management

- Blood pressure control

- Understanding your condition

In addition, some studies have shown increased liver function levels for people with type 2. If that has happened to you, let us know as it could affect underwriting.

How Much Does Life Insurance Cost with Diabetes

The price you pay will depend on what type of diabetes you have, how well your condition is controlled, and other health factors.

Type 1 Diabetes Life Insurance Rates

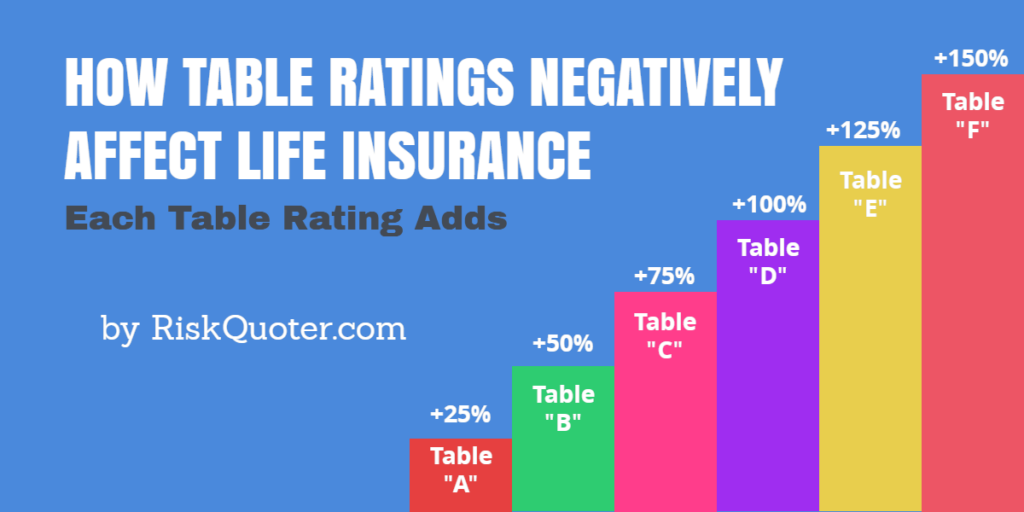

Life insurance is expensive, and underwriters will add a table rating to your policy. Your policy will be 50 – 275% more expensive than for someone who does not have diabetes.

Example: Type 1 Diabetes—$500,000 of 20-year term life insurance, non-smoker monthly rates as of 6-6-2024. The most likely outcomes are highlighted.

| Age | Female | Male |

|---|---|---|

| (Table 4-6-8 rates) | (Table 4-6-8 rates) | |

| 30 | $46 – $56 – $66 | $54 – $66 – $78 |

| 35 | $52 – $64 – $76 | $63 – $77 – $91 |

| 40 | $70 – $86 – $102 | $87 – $107 – $128 |

| 45 | $110 – $136 – $162 | $142 – $176 – $210 |

| 50 | $161 – $200 – $239 | $227 – $283 – $339 |

| 55 | $242 – $300 – $359 | $348 – $433 – $519 |

Type 2 Diabetes Life Insurance Rates

Type 2 diabetes is all about control once diagnosed. Better rates may become available as more time passes.

The best case scenario is a “standard plus” rate for those with A1C levels of 7 or less and all lab results within normal ranges.

Example: Type 2 Diabetes—$500,000 of 20-year term life insurance, non-smoker monthly rates as of 6-6-2024. The most likely outcomes are highlighted.

| Age | Female | Male |

|---|---|---|

| (Standard – Table 2- Table 4 rates) | (Standard – Table 2- Table 4 rates) | |

| 30 | n/a – n/a – $43 | n/a – n/a – $52 |

| 35 | n/a – $40 – $50 | n/a – $47 – $60 |

| 40 | n/a $53 – $68 | n/a – $66 – $85 |

| 45 | $56 – $83 – $108 | $74 – $107 – $140 |

| 50 | $84 – $121 – $159 | $117 – $171 – $225 |

| 55 | $124 – $181 – $239 | $177 – $261 – $346 |

n/a = rate not generally available.

As you can see above, the rates for well-controlled type 2 diabetes are substantially less expensive than for type 1.

Gestational Diabetes Life Insurance

As if pregnancy isn’t hard enough on your body, your doctor just told you you have gestational diabetes!

Gestational diabetes is diagnosed when glucose intolerance is discovered during pregnancy.

The future risk of developing type 2 diabetes may be as high as 50% or more significant in the next 10-20 years.

If you are looking for life insurance while pregnant with gestational diabetes, it will be difficult until you’ve had the baby.

After pregnancy, you must ensure glucose levels have returned to normal before applying.

If you had to take insulin during pregnancy, most companies would underwrite you like someone with type 2 diabetes.

However, that can improve if insulin is no longer required and glucose levels are controlled.

How Diabetes Control & Management Impacts Life Insurance

Maintaining good control of your diabetes is the single most important factor in securing affordable life insurance.

Underwriters carefully review your medical history, including:

A1c (hemoglobin A1C or Glycated Hemoglobin)

This test measures your average blood sugar levels over the past 2-3 months. Lower levels indicate better control.

- Less Than 7.0 = Optimal Control

- 7.1 – 8.5 = Average Control

- 8.6 – 10.0 = Poor Control

- Greater Than ten = No Control

For A1C levels of 10 or greater, guaranteed issue coverage is the only option available.

Estimated Average Glucose – eAG

The American Diabetes Association has been promoting the estimated Average Glucose – eAG reading.

The eAG numbers closely resemble blood glucose readings, making it easier for individuals to understand.

Fasting Blood Glucose

This test measures your blood sugar levels after fasting for 8 hours or more, providing a snapshot of your diabetes control.4

- Normal – 100 md/dl or less

- Pre-Diabetes/ Impaired Glucose – 100 – 125 mg/dl

- Diabetes – 126 mg/dl or greater

Fructosamine

Fructosamine provides an indication of blood sugar control over three weeks.

- Less than 1.7 mg/dl is considered excellent control.

- Levels between 1.7 – 1.9 mg/dl indicate good control.

Life insurance companies do not as widely use fructosamine testing as HbgA1c testing.

Urine Microalbumin/Creatinine Ratio

The urine microalbumin/creatinine ratio, or the ACR test, may indicate kidney-related problems.

Life insurance underwriters are looking for a Urine Microalbumin/Creatinine ratio of 0 – 0.010 mg/mg.

This number should be a zero on lab testing.

Medications & Dosages

Insurance companies consider your medications and dosages when underwriting. If your treatment plan has changed over time, that may help (or hurt).

In addition, let us know if you take other medications for high blood pressure or high cholesterol?

Compliance with Medical Advice

In addition to lab results, underwriters look for consistent compliance with your doctor’s recommendations.

Regular checkups, medication adherence, and a healthy lifestyle (including diet and exercise) demonstrate good control and can lead to better rates.

If your records indicate poor control and lack of follow-up with your endocrinologist, you will pay much more for life insurance, or you could just get declined.

Diabetes and Other Health Issues – How They Affect Life Insurance

Underwriters look at other conditions to determine if the diseases are caused by diabetes or if they create additional underwriting concerns.

Heart health issues are a primary underwriting concern.

When heart issues and diabetes are present, life insurance underwriting becomes more complicated.

Issues like heart attack history, aortic stenosis, or regurgitation are significant underwriting concerns.

It typically leads to more expensive life insurance rates.

Kidney health problems are of great concern to underwriters.

Suppose you have a history of lab results showing protein in the urine. Underwriters will look more closely for potential kidney health issues in that case.

Retinopathy & Neuropathy – Severe problems will either increase life insurance rates or cause a decline.

Insulin Shock/Diabetic Coma – If you have experienced insulin shock or a diabetic coma, the availability of life insurance depends on when it happened.

What caused the insulin shock/diabetic coma, and how much time has passed since this occurred?

Specialty Programs for Diabetes

If you’re looking for a specialty program that rewards healthy lifestyles, John Hancock has their Aspire program for people with diabetes.

How Aspire works:

Currently, Hancock offers the Vitality program that rewards healthy living choices. The benefit is the potential for reduced premiums.

In addition to Vitality, the Onduo program is designed to help you improve your overall diabetes management and reward you for those choices.

The bottom line is that the Aspire program may help you lower your premium expenses.

What to Expect During The Underwriting Process for Diabetes

Life insurance underwriters will want to know the following about your medical history:

- Do you have type 1, type 2, or gestational diabetes?

- How old were you when diagnosed?

- What kind of treatment do you receive to control diabetes?

- What is your history of control? HbA1c, Fasting Blood Glucose, Protein, Microalbumin/Creatinine.

- What are your average blood pressure and cholesterol readings?

- Do you follow your doctor’s orders?

- Do you visit your doctor regularly?

- Have you had any diabetes-related complications?

- Do you have any other health problems? Epilepsy, cancer history, etc.

- What are your diet and exercise habits?

If you participate in other activities, such as scuba diving or aviation, let us know, as some companies are better than others.

Life Insurance for Diabetics Articles

One Minute Underwriting Video – New Video

29 Million Reasons to Learn about Diabetes Life Underwriting – the number one news source for insurance agents, asked me to write about diabetes.

Frequently Asked Questions About Diabetes and Life Insurance

The best life insurance for diabetics will depend on your exact circumstances, but the following are the most common questions we receive.

For most people with diabetes, term life insurance offers the most amount of coverage at the lowest possible rate.

Can people with diabetes get life insurance?

Yes! You can get life insurance for diabetes if you choose the right life insurance company.

Affordable life insurance for diabetics is available whether you have type 1, 2, gestational, or pre-diabetes.

I was just diagnosed with diabetes. Am I able to buy life insurance today?

Yes and No. The most competitive companies will make you wait 3-6 months after diagnosis to evaluate your control.

Sometimes, the only type of life insurance available will be a guaranteed issue policy.

Rates may improve even more once you have demonstrated diabetic control for 12-24 months.

I was declined due to my A1c test. What do I do now?

The first thing to do is to request a copy of the lab results from the life insurance company.

Once available, you must visit your physician for a complete evaluation.

If it turns out that you have diabetes, it will take some time for your doctor to gain control and begin medications.

We usually recommend starting working with you about three months after diagnosis.

If one company offers me a rated policy, will all companies provide the same rate class?

No!

Each life insurance company has its own guidelines; some companies do better underwriting than others.

If you let us know what company you applied to, we’ll let you know if other more favorable options exist.

How Often Can I Re-Shop for a Better Life Insurance Deal?

You may shop for life insurance coverage as often as you like.

Many of our clients come to us after working with another agent.

You may feel that your existing life insurance may not be the best price available; you may be right.

There is no obligation or pressure with our life insurance service.

We’ll tell you during our conversation if we think you can do better than you currently have.

What else can I do to improve my chances?

Improving your health, taking medications, and following doctor’s orders are the best things you can do.

If you are not currently exercising, begin a routine under your doctor’s supervision.

Weight loss and improved fitness will help with underwriting.

If you smoke, quit.

Smoking and diabetes are massive concerns.

Both contribute to the hardening of your arteries, increasing the risk of heart attacks and strokes.

Guaranteed Issue Life Insurance

Sometimes, traditional life insurance is not available due to health problems or maybe due to the policy need being small.

In those cases, a guaranteed whole life insurance policy for diabetics may be the best option.

Compare our opportunities to companies like Colonial Penn or AARP life insurance policies.

It often makes sense to shop for a traditional life insurance policy first.

We can switch to guaranteed issue life insurance policies if no other options exist.

No Medical Exam Life Insurance Options for Diabetics

No medical exam life insurance products are available.

It may be worth considering if you do not want to give a blood and urine sample.

Keep in mind that no exam life insurance policies still involve underwriting.

To qualify for life insurance with no exam, you’ll need medical records showing a history of compliance and control.

Top 5 Life Insurance Tips for Diabetics

Our top 5 life insurance tips for people with diabetes will help you save money on your life insurance.

Some companies specialize in diabetes life insurance underwriting.

They will offer you better rates than companies that do not understand diabetes.

Diabetic Underwriting Tip # 1 – Control

The single most important factor from an underwriting point of view is your diabetic control.

The better your control, the more favorable the underwriting outcome.

Underwriters examine your HbA1c history, estimated average glucose, and other lab results.

Diabetic Underwriting Tip # 2 – Compliance

Following your endocrinologist’s orders is critical. Do you visit your physician for regularly scheduled checkups?

Do you take your medication as prescribed?

Have you made improvements to your diet and exercise programs since being diagnosed?

Diabetic Underwriting Tip # 3 – Complete Medical History

We need to know about your entire diabetic history.

Remember that we work for you and want to help you find the best rate based on your diabetic history.

We need to know about your history of diabetic control, any complications you may have had, and improvements to your health.

If you have other medical issues now or in the past, let us know so we may help you.

Diabetic Underwriting Tip # 4 – Common Sense

In the world of life insurance underwriting, consumers who understand the severe nature of their diabetes make better candidates for life insurance companies.

Your underwriting outcome will improve when your records show you understand your condition and take positive steps to control your diabetes.

Diabetic Underwriting Tip # 5 – Underwriting Expertise

Work with an expert who understands life insurance underwriting for people with diabetes.

Each company has its own set of underwriting guidelines.

Some companies are better with type 2 diabetes, while others are better with type 1 diabetes.

The life insurance agent helping you should know what questions to ask about your diabetic history.

Whether non-medical life insurance for people with diabetes or fully underwritten life insurance for diabetics, we’ll show you the best life insurance options available.

Please take a few minutes to complete your quote request today.

FAQ

You have questions about life insurance for diabetes, and we have the answers.

Recent Articles:

We work with all types of health conditions, from asthma, cancer, HIV, heart disease, and so much more.