A history of melanoma or other skin cancers doesn’t automatically disqualify you from getting life insurance.

In fact, many people are approved at standard or better rates, depending on the type of cancer, stage, treatment, and time since recovery.

This guide covers how melanoma and other skin cancers impact life insurance, the best strategies for approval, and which life insurers offer the most favorable underwriting offers. You’ll learn:

How Skin Cancer Affects Life Insurance

When you apply for life insurance after a melanoma or other skin cancer diagnosis, underwriters review several key factors:

What Underwriters Look For

- Type of cancer: Melanoma, basal cell carcinoma (BCC), squamous cell carcinoma (SCC), or pre-cancerous conditions like dysplastic nevi.

- Stage and severity: Tumor depth (Breslow), ulceration, lymph node involvement, and recurrence.

- Treatment details: Surgery, Mohs surgery, radiation, chemotherapy, and location of the cancer.

- Time since treatment: The more time that passes, the better the underwriting outcome.

- Overall health history: Additional conditions (e.g., diabetes, gastrointestinal conditions, heart conditions, other cancer history, asthma, stroke, etc. can impact offers.

- Follow-up care: Ongoing visits to your dermatologist are viewed favorably.

Providing us with your pathology report is one of the most important steps you can take. It enables us to give the underwriters accurate information, allowing them to assess your risk correctly.

Underwriting Deep Dive: What Really Matters

Life insurers use detailed pathology and treatment reports to decide eligibility and pricing. Here’s what they focus on:

- Breslow Depth: Measures tumor thickness. Under 1.0 mm is considered to be in the early stage.

- Clark’s Level: Older metric still used in older reports. Indicates how deeply the melanoma has grown into the skin layers.

- Ulceration: Indicates aggressive cancer. Ulcerated tumors receive higher ratings.

- Lymph Node Involvement: Expect a minimum 5-year postponement period.

- Recurrence: Any return of melanoma increases risk substantially.

Insurers will request biopsy reports, surgical notes, and dermatology follow-up records. These details help them decide whether you’re standard, table-rated, receive a flat extra, or are postponed.

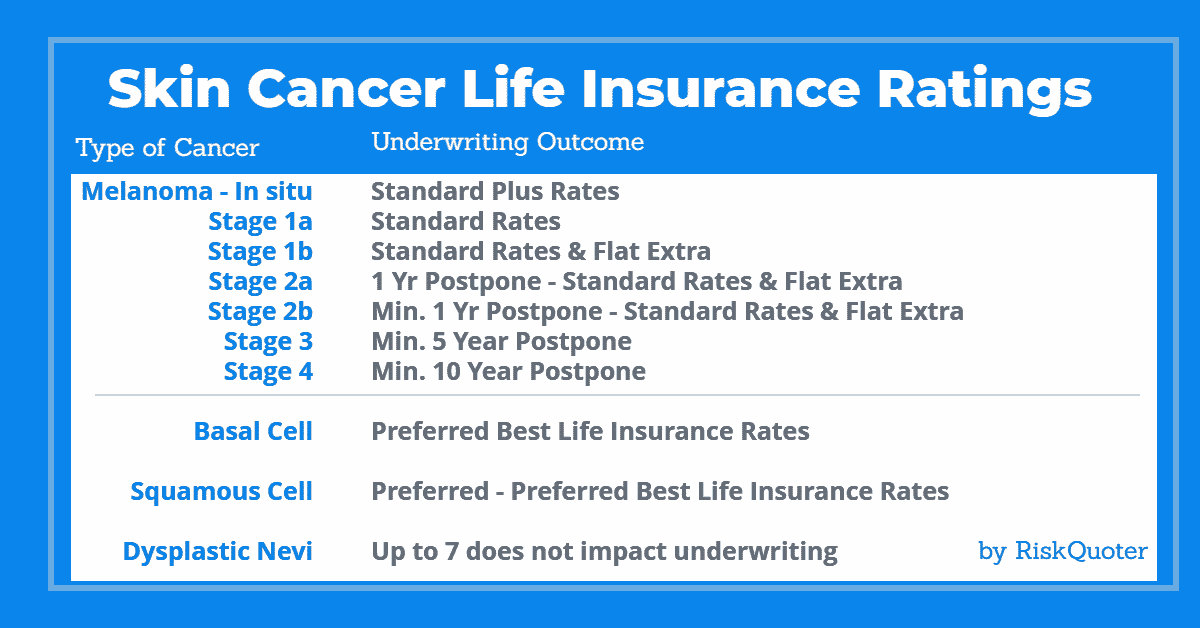

Life Insurance Options by Melanoma Stage

According to the American Cancer Society, doctors expect to diagnose approximately 105,000 cases of melanoma in the United States in 2025.

Underwriting guidelines vary significantly based on the type, stage, treatment options chosen, and time since diagnosis and recovery.

Melanoma In Situ & Stage 1

Life insurance is usually available right after surgery for melanoma in situ or Stage 1a/1b. Some companies may even offer Standard Plus rates.

Real-Life Example: In Situ

A 47-year-old woman had a 0.1 mm melanoma in situ removed via Mohs surgery. She applied after healing and received:

- Standard Plus – Banner Life, Prudential, Mutual of Omaha

- Standard – Lincoln Financial, Protective, John Hancock

Banner Life offered the best price for her.

Real-Life Example: Stage T1a

A man had Stage T1a melanoma removed (less than 1 mm, no ulceration). Offers included:

- Standard – Lincoln, Prudential, Protective

- Postponed – Corebridge, Pacific Life, Banner

Lincoln had the most competitive rate.

Real-Life Example: Stage T1b

T1b melanoma is thicker (over 0.8 mm) or ulcerated. One client applied a few months post-surgery and got:

- Standard + Flat Extra – Prudential, Lincoln, Mutual of Omaha

- Table 4 – Corebridge

He chose Corebridge for the price. We expect standard rates to become available with more time.

Additional Case Study: Recurrent In Situ Melanoma

A client with two separate in situ melanomas (2 years apart) was approved by Protective at standard rates but declined by Pacific Life and Mutual of Omaha—the time since the most recent removal was the deciding factor.

Stage 2 Melanoma

With Stage 2, companies typically postpone coverage for at least 12 months after treatment. Once eligible, you’ll likely receive:

- Flat Extra of $750–$1000 per $100,000

- Possibly a table rating depending on size, location, and follow-up

Competitive companies: Prudential, Lincoln National, Protective Life

Stage 3 Melanoma

With spread to nearby lymph nodes, insurers will postpone coverage for at least 5 years after your last treatment.

When coverage becomes available:

- Table ratings are common (often Table 4–6)

- Flat Extras range from $1,500 to $2,000 per $100,000 of coverage, lasting 5 to 7 years.

Stage 4 Melanoma

Life insurance companies decline coverage for stage 4 melanoma (metastatic disease). Fully underwritten life insurance isn’t available.

You may still qualify for:

- Guaranteed issue policies – Up to $25,000, no health questions, 2-year graded benefit

- Accidental death policies – Up to $500,000 coverage, immediate benefits

Life Insurance for Other Skin Cancers

Life insurance rates for non-melanoma skin cancers are competitive, with some companies even willing to consider their best rate classes.

Basal and Squamous Cell Carcinoma

Basal cell carcinoma (BCC) and Squamous Cell Carcinoma (SCC): These non-melanoma skin cancers are the most common and generally don’t affect life insurance eligibility. Most applicants qualify for preferred or better rates after treatment, unless advanced therapies, such as radiation or chemotherapy-based creams, are used.

In that case, you are most likely looking at a standard or standard plus rate.

Pre-Cancerous Skin Conditions & Life Insurance

For example, pre-cancerous conditions such as actinic keratosis or atypical moles (dysplastic nevi) can impact underwriting.

Dysplastic Nevi are existing moles that may resemble melanoma. People who have dysplastic nevi are at a higher risk of developing melanoma. Underwriters consider your history, the number of dysplastic nevi, and the time elapsed since removal.

Obtaining preferred rates for dysplastic nevi is possible. Most companies consider individuals with fewer than 4-6 dysplastic nevi for their preferred rates.

Similarly, actinic keratosis is a skin condition that can sometimes develop into skin cancer if left untreated. Once treated, underwriting follows the same rules as basal cell carcinoma and sometimes squamous cell carcinoma.

FAQ

Yes, but rates and eligibility depend on the stage of the disease, the type of treatment, and the time since recovery.

Non-melanoma skin cancers like basal and squamous cell carcinoma have minimal impact on life insurance. Melanoma’s impact depends on the stage.

Not necessarily. Several factors influence eligibility, including the stage and severity of melanoma, treatment, and the duration since diagnosis.

Secure Your Future with the Right Coverage

A melanoma or skin cancer diagnosis doesn’t mean life insurance is out of reach. You can find coverage that fits your needs with the right insurer and strategy.

Request a life insurance quote today – No pressure, no obligation.

References:

- Skin Cancer Foundation – Basal Cell Carcinoma Overview

- American Cancer Society – Melanoma Key Statistics

- Munich American Reassurance Company – Melanoma White Paper

- Prudential Financial – Rx for Success Skin Cancer

- Legal & General America – Melanoma Case Studies

- AIG – Melanoma Underwriting Guidelines

| Stage | Postpone? | Flat Extra | Likely Outcome? |

|---|---|---|---|

| In situ | No | No | Standard Plus |

| Stage 1a | No | No | Standard |

| Stage 1b | No | Possibly | Std + Flat Extra |

| Stage 2a* | Yes | $750 – $1000 (1) | Std + Flat Extra |

| Stage 2b* | Yes | $1000 (2) | Std + Flat Extra |

| Stage 3* | Yes | $1500 – $2000 (3) | 5 Year Postpone |

| Stage 4* | Yes | Yes (4) | 10 Year Postpone |

(1) $750 – $1000 per every $100,000 of coverage for 5 – 7 years

(2) $1000 per every $100,000 of coverage for 7+ years

(3) $1500 – $2000 per every $100,000, plus a table rating

(4) Stage 4 melanoma has a minimum 10-year postponement.