Life insurance applications and claims may get denied for any number of reasons. This article explains how to handle this situation to achieve the best possible outcome.

Life Insurance Application Denied

Getting declined for life insurance is frustrating and anxiety-producing. You probably applied for coverage, expecting approval for a policy, when you get a call from your agent or a letter declining your application.

Don’t give up! There are many reasons for getting declined for life insurance, but that doesn’t mean all companies will deny you.

We’ve helped many people find affordable life insurance after an initial denial. and chances are that we can help you too!

Don’t let a prior life insurance application outcome discourage you.

We outline the most common reasons for life insurance denials below.

Medical History

The most common reason for getting denied life insurance is due to your medical history.

Most medical history declines fall into the following categories:

- You applied to the wrong life insurance company.

- You have an uninsurable medical condition.

- Not enough time has passed since treatment.

- You don’t follow your physician’s recommendations.

If you were denied life insurance due to medical history, you might still be insurable. With our expertise, we can tell you if you are insurable, when coverage will be available, and what to expect in terms of price.

Some companies specialize in high-risk life insurance underwriting…Just because one company declines your application doesn’t mean they all will.

A good example is heart attack survivors applying soon after their heart attack. Sometimes, you have to wait a few months to get coverage.

The same goes for heart bypass surgery. If you apply too soon, your application may be postponed or declined.

Other complicated health issues that require specialty underwriting expertise include aortic stenosis, heart valve problems, etc.

Your beneficiaries may also be denied life insurance if you fail to disclose mental health conditions.

For some conditions like Relapsing-Remitting Multiple Sclerosis, it’s important to work with the right companies, otherwise you will be declined.

Lab Results

Everything seems fine, and then you take your life insurance medical exam.

Soon after, you get declined due to your lab results.

It happens sometimes, and I can say that in the past 20+ years, most of these cases have become insurable.

Life insurers are quick to decline or postpone coverage for unexpected lab results.

The first thing you should do is request a copy of your lab results.

Some typical lab results that may get you declined:

- Bilirubin greater than 6.0

- Denied life insurance due to HIV Positive

- Positive for cotinine (nicotine metabolite) when your application says you never used tobacco.

- PSA levels above cutoff limits by age

- Creatinine Clearance Levels below 55 ml/mn.

- Denied life insurance due to elevated liver enzymes

- Hemoglobin is less than 11 gm/dl without a prior history.

- Brain Natriuretic Peptide (BNP) – NT-proBNP levels greater than 1,000 pg/ml without cardiac workup history.

- Abnormal Calcium levels above 1.5

- Positive Carbohydrate Deficient Transferrin (CDT) with a history of abuse, DUI, etc.

- Positive for illegal drugs, including marijuana, if it was not disclosed on the application.

- Estimated Glomerular Filtration Rate (eGFR) levels below 60 when there is no prior kidney history

- Hepatitis without a prior diagnosis

- Protein levels greater than 200 mg/dl

- Diabetic control – HbA1C greater than 10

- High cholesterol above 300

When a client gets denied life insurance, we try to get coverage with another company before exploring new tests and labs.

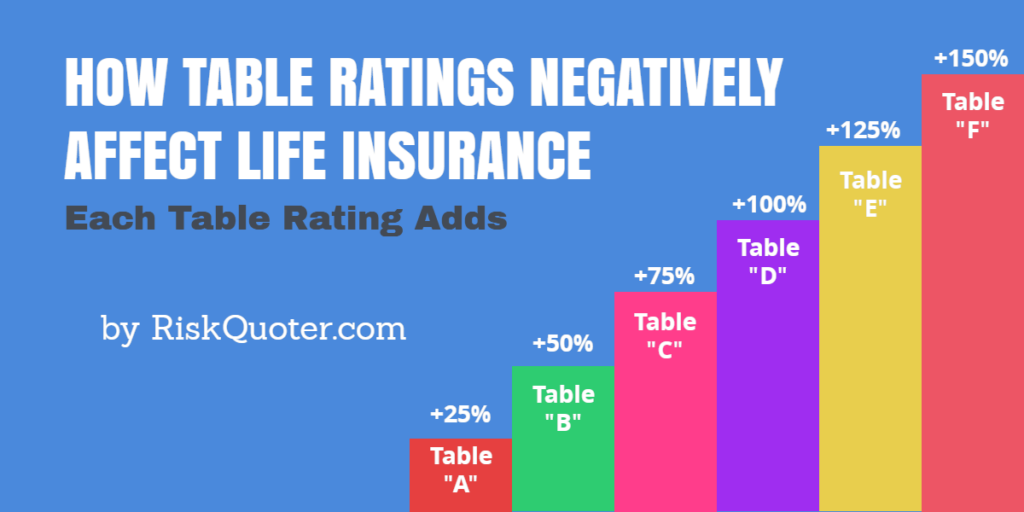

You may end up with a life insurance policy with a table rating, but that’s better than having no policy.

The reason is this: If we can get another company issue coverage now, we should do that first.

That way, you’ll have coverage if it turns out to be a severe health issue. If it was a temporary lab issue, we could apply for new coverage when the results are normal.

Many top 10 health problems will decline you with the wrong company.

Recent Articles:

Get the Best Life Insurance Table Rating for Your Situation

Top 10 Health Problems in America

Kidney Cancer Survivors – Life Insurance is Available!

If you’ve had kidney cancer and need life insurance, we can help you. Finding life…

Life Insurance for Throat Cancer Survivors

We specialize in high-risk life insurance underwriting for throat cancer survivors. While head and neck cancers…

Life Insurance After Colon Cancer: A Step-by-Step Guide

Addison’s Disease Life Insurance

If you have Addison’s Disease and need life insurance, let us help you. Our life…

Medical Records

You may get denied life insurance if you have unfavorable notes in your medical records.

If you’ve been declined due to your medical records, it usually is one of four things in the notes:

- Your doctor recommended testing, and you have not completed those tests.

- You’re scheduled for an upcoming surgery.

- If you mentioned a history of drug use, there might be notes in your records.

- Your Physician’s office mixed up your records with someone else with the same name.

If you lost significant weight recently due to exercising, insurers might decline you if it’s not explained in your records.

Life insurers will postpone or decline your application if a recommended test has not been completed, such as a colonoscopy or cardiac workup for someone with heart disease.

If substance abuse is mentioned in your records but not admitted on your application, that is difficult to overcome.

We’ll work with you to resolve this, but it could take time.

Some family history medical issues such as Huntington’s disease will cause a decline for you,

Unless you have the genetic testing results that show you don’t have it.

Mixed-up medical records happen more often than you think, especially with common names.

It may take a little time, but we’ll get this fixed when we work with your physician’s office and our medical records company.

Prescription History

Sometimes, the life insurance company will decline you due to your prescription history.

When that happens, it’s usually due to one of the following:

- Not disclosing prescriptions on the application

- Having prescriptions for high-risk medical conditions that are uninsurable

Not Disclosing Prescription Medications

There are two scenarios that we encounter regularly.

The insured forgot to mention one of their medications and completely lied on the application.

Life insurance companies today use prescription databases that tell them about your prescription history.

Sometimes, the insured was prescribed a medication that they never used but will still appear in the databases. It’s pretty easy to address with a letter from your doctor.

A more frequent issue lately revolves around medical marijuana. In this day and age, medical marijuana is no big deal with the right companies as long as it’s disclosed on the application.

If you fail to disclose the marijuana use upfront and your lab results are positive, you’ll get declined. If that happens, the easiest thing to do is move to a new company and fully disclose everything.

Uninsurable High-Risk Prescription History

There are several medications where life insurance companies will decline you as soon as they see the medication history.

Examples include medications used for:

- Dementia medications

- Schizophrenia medications

- Chemotherapy medications

- HIV Positive medications (except for companies that insure HIV+)

- Pain medications – when multiple medications are involved

Whatever your history is, let us know, and we’ll do our best to find coverage for you.

Recent Treatment

Most companies require time to pass after treatment before offering you life insurance.

If you’re looking for life insurance after cancer,

The type of cancer and treatment details will determine when life insurance is available.

Life insurance for heart disease will depend on the type of heart condition and treatment received.

Let us know your treatment recently, and we’ll tell you what to expect regarding a postponement period.

If you were hospitalized for a severe asthma attack, there will be a postponement period before coverage is available

Driving Record

Most life insurers use their points system to assign point values to different infractions.

The total of all motor vehicle violations will dictate if life insurance is available.

Your age at the time of the violations, time since the motor vehicle violations,

And most importantly, the types of violations determine your underwriting outcome.

Life insurance after vehicular homicides will require individual consideration by underwriting departments.

Multiple DUIs, reckless driving, and speeding violations of 40 mph over the limit can quickly get you declined.

When your driving history gets you declined, let’s talk about it.

We’ll contact underwriters on your behalf to see if we can get life insurance for you at a reasonable rate.

Criminal Record

The availability of life insurance depends on your current status.

What crime were you convicted of, and how’s your criminal history?

- Charges Pending = Postpone

- Awaiting Trial of Sentencing = Postpone

- Currently in Jail = Postpone

- On Probation or Parole = Postpone

Misdemeanors – Once off probation, life insurance is available at standard rates.

You may be able to get a preferred rate depending on the details.

Single Felony – Insurers may postpone coverage for one year after you get off probation.

At that time, you may receive an offer with an additional expense called a flat extra.

As more time passes since the end of probation, the rate class available tends to improve.

Examples of single felonies include grand theft, larceny, assault, and involuntary manslaughter.

Multiple Felonies or Major Felonies – Life insurance companies will most likely decline to offer you coverage.

Major felonies include drug trafficking, organized crime, rape, murder, terrorist acts, etc.

Our best advice is to tell us about your history.

We’ll contact insurance companies for feedback to see if we can get you coverage.

Denied for Other Reasons

If you’ve been denied because you participate in activities such as:

- Scuba diving

- Mountain climbing

- Private piloting

You just applied to the wrong life insurance company, and we can help you fix that quickly.

We’ll show you the options available based on your activities.

Denied Life Insurance Options

If you were denied life insurance, what should you do next?

Get the exact details as to why you were declined.

The life insurance company has to send you a letter stating why you were declined.

Do you need life insurance for a divorce decree?

Let us know, and we can prove you are trying to obtain coverage.

Request a copy of your lab results if it was due to the paramed exam results.

Call your physician if the denial was due to notes in your medical records. Mistakes are made all the time.

An option available to have some coverage is an accidental death insurance policy.

There’s no pressure or obligation with our life insurance service.

We’ll provide you with the information you need to make an informed decision about your next steps.

Life Insurance Claim Denied

Your life insurance company may investigate your death and deny the life insurance claim if you committed fraud to obtain your insurance policy.

Generally speaking, there is a two-year contestability period after the policy is issued where the company can deny your death claim for fraud.

More recently, with the increased automated underwriting and fewer paramed exams, life insurers may use these two years to rescind your life insurance policy for fraud.

Can you be denied life insurance due to drug use?

Maybe. It depends on the exact circumstances.

The insurance company will investigate if death occurs before the 2-year contestability period ends. If they find that you had a drug history and did not admit that on the application, the life insurer may try to deny your claim.

It would be difficult for a life insurance company to deny death claims that occur after the contestability period.

If your life insurance claim is denied, you should contact a lawyer to see what options are available.

The bottom line is that you want to be truthful and accurate in disclosing all relevant information so that the insurance company pays your life insurance claim.

FAQ

You have questions about getting denied life insurance, and we have the answers!

Final Thoughts

There is never any pressure or obligation with our life insurance service.

We’ll shop for the best life insurance options and help you find companies that want your business.