Having thyroid cancer or thyroid diseases might complicate getting life insurance, but it won’t stop you from finding affordable life insurance if you work with the right life insurance companies.

In this guide, we show you how we help cancer patients and survivors, as well as those with thyroid conditions find affordable coverage.

Life Insurance After Thyroid Cancer: What Rates Can You Expect

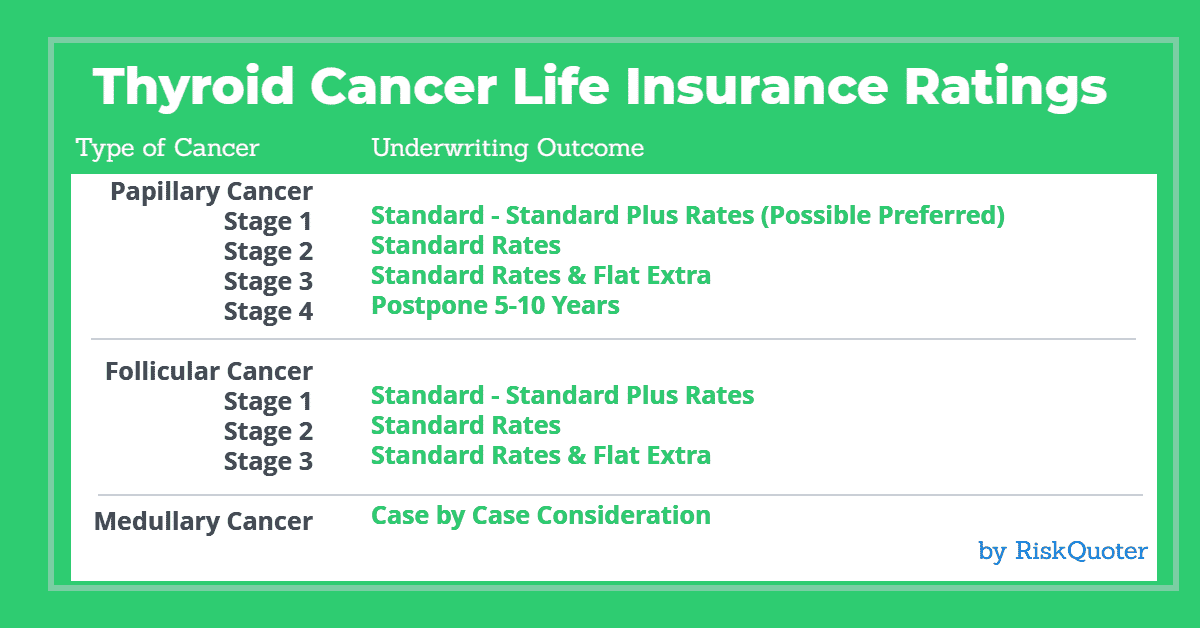

Life insurance underwriting for thyroid cancer depends heavily on the type, stage, and how long it’s been since your treatment ended. Here’s a quick overview for papillary thyroid cancer, the most common type:

| Cancer Stage | Possible Life Insurance Rates |

|---|---|

| Stage 1 | Standard – Standard Plus (rarely Preferred rates) |

| Stage 2 | Standard rates (possible waiting period) |

| Stage 3 | Standard rates plus flat extra (waiting period required) |

| Stage 4 | 5-10 year postponement. Approval is case by case. |

According to the American Cancer Society, there will be about 44,000 new thyroid cancers in the United States this year.

Thyroid cancer is more common in women than men, and underwriting is based on the type and stage of thyroid cancer you have.

What Life Insurance Underwriters Look For:

- When were you diagnosed with cancer?

- What type of thyroid cancer did you have?

- What was the stage of thyroid cancer?

- Were any lymph nodes positive for cancer?

- How was thyroid cancer treated?

- Has there been any recurrence?

- What medications and dosages do you take?

- Do you have any other health issues?

We use a quick quote process that allows us to shop all companies that specialize in thyroid cancer. The benefit is that you’ll receive feedback about the best options available in a few days.

Papillary Thyroid Cancer Life Insurance

Papillary thyroid cancer accounts for 80% of all thyroid cancers and is generally the easiest to insure.

- Standard – Standard Plus rates are available (possible preferred in the future).

- Eligibility starts once treatment ends and you’ve had a negative follow-up scan.

- Rates may be more expensive for those diagnosed before 20 or after age 60.

Timeline: You’ll likely be eligible for coverage once you’ve finished treatment and have a negative radioisotope scan.

Follicular Thyroid Cancer: Similar Coverage

Good News: Follicular thyroid cancer is the second most common type, with underwriting similar to papillary cancer.

| Cancer Stage | Underwriting Range |

| One | Standard Plus Rates |

| Two | Standard Rates |

| Three | Standard with a flat extra expense |

Important: Advanced cases, or Hurthle Cell carcinoma, have longer postponements due to higher risks.

Medullary Thyroid Cancer: Special Considerations

Medullary thyroid cancer is more aggressive and appears earlier in life, meaning insurers are cautious:

- Wait periods typically last 3–5 years after treatment.

- Frequent calcitonin level checks are needed to confirm stability.

Part of the reason for the longer postponement periods is that medullary cancer may not respond to radioactive iodine treatment as well as papillary cancer.

Anaplastic Thyroid Cancer: Limited Options

Due to its aggressive nature, traditional life insurance typically isn’t available. However, you may qualify for:

- Guaranteed issue final expense insurance: No medical questions asked, but has a graded benefit period (usually 2 years).

- Accidental Death Policies: Provide coverage for accidental death only.

We can help you explore these options.

Thyroid Conditions and Life Insurance

Millions of Americans live with thyroid diseases like hyperthyroidism and hypothyroidism, and insurers are familiar with these conditions. Here’s how they impact your insurance rates:

Hyperthyroidism (Overactive Thyroid)

Graves’ Disease is the most common reason for an overactive thyroid gland in the U.S.1

Other causes include thyroid nodules or goiters. (enlarged thyroid)

Symptoms of hyperthyroidism (Graves) may include:

- Eye Disease

- Rapid Heartbeat

- Weight Loss

- Anxiety

- Tiredness and Muscle Weakness

If you’ve been diagnosed with hyperthyroid, you may have to wait 3-6 months before applying for life insurance to give insurance companies time to rule out other conditions like adenoma, hyperplasia, or thyroid cancer.

Hyperthyroidism elevates thyroxine (T4) and triiodothyronine (T3) while lowering your TSH level.

Common treatments for hyperthyroidism are medications or surgery.

Hyperthyroidism (Graves) Life Insurance Rates

| Age | Female | Male |

|---|---|---|

| 35 | Preferred – $22 Standard Plus – $29 Standard – $32 | Preferred – $26 Standard Plus – $34 Standard – $39 |

| 40 | Preferred – $30 Standard Plus – $38 Standard – $43 | Preferred – $36 Standard Plus – $46 Standard – $55 |

| 45 | Preferred – $42 Standard Plus – $58 Standard – $66 | Preferred – $55 Standard Plus – $74 Standard – $87 |

| 50 | Preferred – $65 Standard Plus – $84 Standard – $97 | Preferred – $84 Standard Plus – $117 Standard – $129 |

| 55 | Preferred – $96 Standard Plus – $124 Standard – $148 | Preferred – $133 Standard Plus – $177 Standard – $218 |

The worst-case scenario for someone with hyperparathyroidism (Graves’) with no other health issues is a “standard” rate.

Many people even get “standard plus” or “preferred” rates, which are even better.

If you have complications like kidney stones, muscle weakness, mental confusion, or heart problems, your rates may be higher.

High calcium levels above 11.0 mg/dl can also increase your rates.

Hypothyroidism and Life Insurance

Hypothyroidism means your thyroid doesn’t make enough hormones.

It is often caused by Hashimoto’s disease, an autoimmune condition that attacks your thyroid.

This can lead to low levels of thyroid hormones (T4 and T3) and high levels of TSH, a hormone that signals your thyroid to make more.

Symptoms of hypothyroidism may include:

- Tiredness

- Weight Gain

- Depression

- Lowered Calcium Levels

The most common treatment for thyroid conditions is medication or radioactive iodine therapy.

More extreme cases may require surgery.

Hypothyroidism Life Insurance Rates

| Age | Female | Male |

|---|---|---|

| 35 | Preferred – $22 Standard Plus – $29 Standard – $32 | Preferred – $26 Standard Plus – $34 Standard – $39 |

| 40 | Preferred – $30 Standard Plus – $38 Standard – $43 | Preferred – $36 Standard Plus – $46 Standard – $55 |

| 45 | Preferred – $42 Standard Plus – $58 Standard – $66 | Preferred – $55 Standard Plus – $74 Standard – $87 |

| 50 | Preferred – $65 Standard Plus – $84 Standard – $97 | Preferred – $84 Standard Plus – $117 Standard – $129 |

| 55 | Preferred – $96 Standard Plus – $124 Standard – $148 | Preferred – $133 Standard Plus – $177 Standard – $218 |

As you can see, underwriting has rates similar to those of hyperthyroid.

More expensive premiums are due to secondary health issues that the insured has, rather than hypothyroidism itself.

We help with all types of health conditions, including asthma, skin cancer history, diabetes, and heart disease.

Thyroid Cancer Life Insurance FAQ

Yes, you can get life insurance often within a few months of surgery!

Life insurance depends on your age when diagnosed, cancer stage, type of cancer, and treatment received.

Yes, there are life insurance companies that specialize in cancer underwriting.

Do you participate in other activities, such as scuba diving or aviation?

Let us know, as some companies specialize in these areas.

Final Words

Life insurance offers financial security for your loved ones if you pass away.

While thyroid conditions can pose challenges in getting life insurance, we specialize in finding solutions for you.

We can also help with other conditions, such as sleep apnea or high blood pressure.

We help you find the right life insurance company for your needs so that you can protect your loved ones with the best possible rates.

Our service is always free and without obligation.