Did you know that life insurance for heart patients is entirely possible?

In the United States, statistics show that more people die from heart disease and stroke than cancer.

Most people with heart conditions can qualify for coverage.

How Does Life Insurance for Heart Patients Work?

Life insurance for heart patients falls into the high-risk underwriting category.

Heart conditions we insure include:

- How Does Life Insurance for Heart Patients Work?

- Term Life Insurance for Heart Attack Victims

- Atrial Fibrillation Life Insurance

- Life Insurance After Heart Stents

- Life Insurance with Coronary Artery Disease

- So, how do you get life insurance if you have coronary artery disease?

- Coronary Artery Calcium Score

- NT-proBNP

- Bypass Surgery Life Insurance

- Life Insurance After Heart Valve Surgery

- Pacemaker Life Insurance

- Abdominal Aortic Aneurysm Life Insurance

- Abnormal EKG Life Insurance

- High Blood Pressure Life Insurance

- Bundle Branch Block Life Insurance

- Life Insurance for Angina

- Aortic Stenosis Life Insurance

- Heart Murmur Life Insurance

- Final Thoughts

Our quick quote process gives you feedback from insurers specializing in your condition in a few days.

Here’s what we need to know:

- What was your exact heart condition diagnosis?

- When were you diagnosed with this condition?

- Did you have surgery?

- What procedure was completed and when?

- Have you completed all follow-up tests and treatment?

- Has any treatment/surgery been recommended that you have not finished yet?

- What is your current health?

- Have you made positive lifestyle changes since treatment?

- Do your parents/siblings have a history of heart problems?

- If you were a smoker, when did you quit?

- Do you take medications for hypertension or high cholesterol?

The benefit of our quick quote is that you’ll know the pricing and which companies are best before applying.

A Quick Quote is an initial estimate of life insurance rates by company.

Term Life Insurance for Heart Attack Victims

Here’s everything you need to know about getting term life insurance after a heart attack (myocardial infarction) victims.

In the past, the only option would have been some overpriced whole life insurance policy, but not anymore.

With heart attacks, life insurers review:

- What caused your heart attack

- The damage to your heart from the attack

- Treatment received

- Cardiac test results

- Degree of recovery from the heart attack

Positive lifestyle changes also help

- Improvements to diet

- Exercise

- Quitting tobacco

- Meeting with your cardiologist regularly

Affordable life insurance after two heart attacks is even possible for many insureds.

We’ll review your heart attack history and tell you what information we need to provide accurate quotes.

Atrial Fibrillation Life Insurance

Can I get life insurance for atrial fibrillation? Yes! Most people with AFib are readily insurable.

Life insurers’ concern with atrial fibrillation is your potential risk of a stroke.

Life insurance rates depend on whether you have paroxysmal (occasional), persistent (chronic), or long-standing persistent atrial fibrillation.

You may have been diagnosed with atrial fibrillation after

- An electrocardiogram

- Holter monitor testing

- Event monitor testing

- Implantable monitor to detect Afib

Underwriting AFib considers:

- The type of atrial fib you have

- Medications you take

- The length of time you’ve had atrial fib

- Surgical history – ablation or maze procedure

- Other heart conditions

We need to know what medications and dosages you take.

Some medications slow the heart down, while others regulate your heart rhythm or prevent blood clots and strokes.

Life insurance rates are more expensive for those with a catheter ablation or maze procedure.

Better rates may become available over time.

For atrial fibrillation caused by heart valve disease, underwriting follows heart valve guidelines mentioned later in this guide.

No matter what type of atrial fibrillation history, we can help you get your best rates.

If you’ve had a stroke related to atrial fibrillation, let us know, as we have life insurers available to help.

Life Insurance After Heart Stents

You may have had chest pain, a heart attack, or just completed a cardiac workup that revealed a clogged artery.

The cardiologist will decide if angioplasty with a stent or coronary artery bypass grafting (CABG) is the best option for you.

Angioplasty is a procedure that inserts a balloon-like device into the clogged artery.

The balloon is expanded and contracted in your artery to improve blood flow.

A wire mesh stent keeps the artery open and the blood flowing.

Underwriters look at:

- Underlying heart conditions

- Number of heart stents received

- Which heart vessels were stented

- Lifestyle before and after treatment (build, tobacco, lipids, exercise)

- Post-treatment cardiac test results

- Time since treatment

The first thing to remember is that there will be a postponed period after getting a heart stent.

The postponement period is typically 3-6 months after the post-surgical cardiac workup.

Life insurers want to see how well your stents work before insuring you.

Postpone periods are shorter for single stents and longer for two or more stents.

In terms of price:

- One stent – Standard Plus – Table Rating 2 (50%) rates

- Two stents – Table 2 (50%) – Table 4 (100%) rates are possible.

- Three or more stents – Offers are based on your exact medical details.

- Each table rating adds approximately 25% to a standard rate.

If you’ve recently had a heart stent implanted, don’t worry – you’re not automatically uninsurable.

Plenty of life insurance companies would like to have your business.

Life Insurance with Coronary Artery Disease

Finding the right life insurance policy can be daunting, especially if you’ve been diagnosed with coronary artery disease.

Coronary Artery Disease, or CAD, occurs when plaque builds up in your coronary arteries.

As this plaque builds up, your arteries narrow and may cause conditions such as:

- angina (chest pain)

- heart attacks

- blockages in your arteries

Your initial treatment may include diet changes, exercise, medications for high cholesterol, or elevated blood pressure.

So, how do you get life insurance if you have coronary artery disease?

Coronary artery disease is when plaque builds up in the arteries, restricting blood flow to the heart.

Underwriters look at your plaque burden – the number of heart vessels with the plaque and the extent of buildup (stenosis).

Underwriting factors include:

- The extent of plaque burden from heart catheterization test

- The number and type of cardiac events you’ve had

- Current symptoms, if any

- Left Ventricular Systolic and Diastolic function (underwriters look at your ejection fraction (LVEF)

- Stress test results, if available

- Any abnormal EKG test results

- Any other vascular diseases

We have a proven process to help coronary artery patients obtain affordable coverage from top-rated life insurance companies.

With coronary artery disease, we’ll ensure you get to the right life insurer based on your history of heart disease.

Coronary Artery Calcium Score

Coronary artery calcium scores (CAC) measure the amount of calcium that has built up in your heart’s arteries.

Electron Beam CT or Multislice CT scans are used to measure the degree of calcification.

CAC scores compare your results to the general population of people of the same age, gender, and race as you.

Coronary artery calcium scores hurt your underwriting chances or have no effect. It rarely helps you in underwriting.

Here’s how coronary artery calcium scores affect life insurance based on age:

- Age 35 or under – CAC score above ten = declined.

- 35-44 – CAC scores to 400 are insurable, with tables 2-3 based on your exact score.

- 45-54 – CAC scores to 1000 are insurable, with table 2-4 rating based on the actual score.

- 55-64 – CAC scores to 1000 insurable. Some CACs over 1000 are still insurable.

- Age 65+ – CAC score over 1000 still insurable, Table 2-4 range.

The most important thing for us is why you had a coronary artery calcium score completed.

With that information, we’ll help you find the best rates available.

NT-proBNP

Brain natriuretic peptide (BNP) is a cardiac-related hormone.

BNP consists of an inactive hormone (NT-proBNP) and an active hormone (BNP).

BNP and NT-proBNP are blood tests used to diagnose and monitor heart failure.

Increasingly, life insurance companies are using NT-proBNP in paramedical exam testing.

According to the Cleveland Clinic, normal levels of NT-proBNP are:

- Age 0-74 = 125 pg/ml or less

- Age 75-99 = 450 pg/ml or less

Why do life insurance underwriters like the NT-proBNP test?

BNP and NT-proBNP give underwriters a crystal ball when evaluating your health.

BNP levels evaluate:

- Left ventricular function

- Right ventricular function

- Pulmonary hypertension

- Atrial fibrillation

- Coronary artery disease

Slight elevations of BNP predict future heart problems and mortality.

How Does Nt-proBNP Affect Life Insurance?

It varies by company, but some general age guidelines are as follows:

- Age 0-59 – NT-proBNP levels under 300 do not affect underwriting

- 60-69 – NT-proBNP levels under 400 do not affect underwriting

- 70+ – NT-proBNP levels under 500 do not affect underwriting

While the NT-proBNP level may not affect underwriting, any heart condition you have affects life insurance rates.

NT-proBNP levels above the levels mentioned add table ratings to your price.

NT-proBNP Testing by Life Insurance Company

The NT-proBNP testing rules vary by company. We pulled the following information from each company’s underwriting guidelines.

- AIG-American General

- Ages 20-39 – $5,000,001+

- 40-44 – $1,000,001+

- 45-49 – $1,000,001+

- 50-55 – $250,001+

- 56-59 – $100,000+

- 60-66 – $100,000+

- 67-70 – $50,000+

- Ages 71+ – $50,000+

- Banner Life

- Any insured over age 60 or if insured has a medical history.

- Lincoln Financial

- All ages – $10,000,000+

- Ages 41-50 – $2,500,000+

- Ages 51 or older – $250,000+

- Pacific Life

- All ages – $10,000,000+

- 18-40 – $5,000,000+

- 41-50 – $1,000,000+

- 51-60 – $500,000+

- 61-70 – $250,000+

- Ages 71 or older – All Face amounts

- Protective Life

- Ages 51-60 – $500,000+

- Ages 61 or older – All face amounts

- SBLI

- Ages 50 or older AND $5,000,000+

We’ll continue to update this as we receive updates from other companies.

Bypass Surgery Life Insurance

Most life insurance companies postpone underwriting for six months to 1 year after your open heart surgery.

In some instances, we’ve gotten coverage after three months.

Here’s what life insurers need to know about your bypass history:

- Did you have a heart attack or other heart condition before bypass surgery?

- When did you have bypass surgery?

- How many heart vessels were bypassed?

- Which vessels were bypassed?

- Have you completed cardiac rehab?

- When was your last stress test conducted?

- What positive lifestyle changes are you making since surgery?

Life insurance companies postpone coverage due to the increased risk of:

- atrial fibrillation

- heart attack

- myocardial infarction

- stroke

- heart arrhythmias

- Blood clots

It is important to show positive test results and good cardiac follow-up before applying for new life insurance.

Life Insurance After Heart Valve Surgery

Typical heart valve issues for life insurance are regurgitation (leaks) and stenosis (narrowing of the valve).

The extent of heart damage you have and the treatment received determines the price of life insurance for heart valve disease.

Our heart valve underwriting expertise includes:

- Aortic Valve Stenosis, Bicuspid Aortic Valve

- Mitral Valve Prolapse and Stenosis, Floppy Valve, Barlow’s Syndrome

- Pulmonary Valve Stenosis

- Tricuspid Valve Regurgitation and Stenosis

Underwriters, look at the treatment you received.

Medication-controlled conditions receive better rates than those with a heart valve surgically repaired.

Rates are more expensive if you have heart valve replacement surgery such as an aortic valve replacement or mitral valve replacement.

Was a mechanical or biological valve used?

Pacemaker Life Insurance

Your path to getting a pacemaker may have started with an abnormal EKG or arrhythmia diagnosis.

A pacemaker is a small device implanted in your chest to help regulate your heart rhythm.

The pacemaker may be a:

- Single chamber

- Dual-chamber

- Bi-ventricular pacemaker

- It may also provide defibrillation

It’s important to know what type you have.

Underwriters want to know:

- What type of pacemaker do you have?

- Have there been any pacemaker malfunctions?

- Perforations when implanted?

- Infections?

- Blood clots?

Based on the above information, we can show you what to expect regarding underwriting and price.

Abdominal Aortic Aneurysm Life Insurance

Life insurance rates for abdominal aortic aneurysms (AAA) depend on if the aneurysm was surgically repaired or medically monitored.

There would be a postponed period of 6-12 months if you had abdominal surgery or endovascular aneurysm repair (EVAR).

Life insurance rates tend to be better for abdominal repairs vs. EVAR.

Life insurance rates after surgery:

- Abdominal Surgery – Table Rating 2 – Table Rating 6 range

- Endovascular Surgery – Table Rating 3 – Table Rating 6 range

As more time passes since surgery, life insurance rates improve, and a standard rate may be possible.

The medically monitored aneurysm postponement period is 12-24 months after diagnosis.

Underwriting depends on the size and stability of the aneurysm.

Life insurance rates for aneurysm monitoring: (aneurysm size in centimeters CM)

- 3 CM or less – Standard rates possible

- 3.1 – 4.0 CM – Table Rating 2 – 4

- 4.1 – 4.5 CM – Table Rating 4*

- 4.6 – 5.0 CM – Table Rating 4 – Decline*

* – To qualify for life insurance, you need regularly scheduled physician visits that monitor the size of the aneurysm.

Most companies will require 2-3 years of stability before insuring you.

Companies will decline coverage if you smoke or have other medical conditions until after surgery.

Abnormal EKG Life Insurance

An abnormal EKG for life insurance may be a minor event or signify a significant underlying heart condition.

Electrocardiograms (EKG or ECG) measure the electrical activity of your heart and graphs it on paper.

The EKG measures your heart’s rhythm, heart rate, P Wave, PR interval, QRS interval, T wave, QT interval, and ST segment.

When the EKG is abnormal, that EKG is referred to a medical director at the life insurer for review.

Depending on the type of abnormality and severity, underwriting may:

- Approve you as applied

- Increase the price of your policy

- Postpone you until a cardiac workup is completed

- Decline you

If you are approved for life insurance with an abnormal ECG, you should accept the offer, even temporarily.

The reason is that you’ll need to undergo a cardiac workup to get a better offer.

If there is an underlying heart condition, the original offer is gone, and you may pay more or, in some cases, be uninsurable.

Bottom line – Get an offer, put it in force, and then we’ll re-shop for something better.

The good news is that many life insurance companies have done away with EKG testing.

Companies offering up to $60 million in coverage with no EKG required.

High Blood Pressure Life Insurance

Life insurance with high blood pressure is possible, even if you take medication.

Better still, the preferred best rates are available with the right life insurance companies if you otherwise qualify!

Underwriters want to know:

- How old were you when diagnosed with high BP?

- Do you take any medications?

- If yes, what do you take, and what dosage?

- Have your medications or dosages changed in the past 12 months?

- What is your average BP reading? (12 and 24-month averages)

- Have you taken positive steps to improve your pressure?

- Do you have any other heart conditions or health issues?

- Do you smoke?

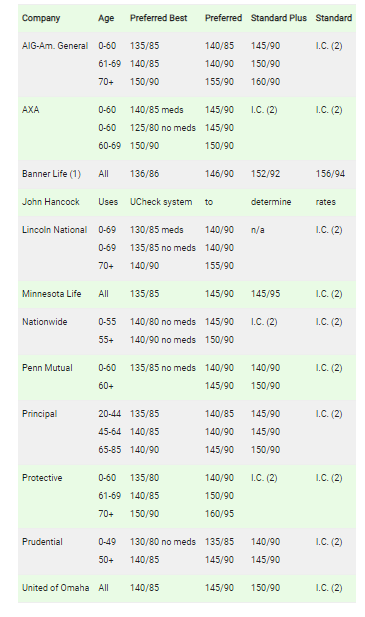

Here’s our blood pressure guide by company.

Blood pressure medications are acceptable unless noted.

FAQ About Blood Pressure

Can you be denied life insurance for high blood pressure?

You may be denied life insurance for high BP, although that is not common.

In most cases, the life insurance company may offer you a rated policy or postpone you until your doctor evaluates the reason for high blood pressure.

What is high blood pressure for life insurance?

Companies publish underwriting guidelines with the blood pressure cutoff for each rate class.

Blood pressure greater than 140/90 may affect life insurance rates.

Is my blood pressure checked during the life insurance exam?

Blood pressure is checked three times during a life insurance exam (paramed), and your pulse once.

How do I lower my blood pressure for the life insurance test?

Steps you can take to lower blood pressure for the paramed exam include:

- Scheduling your exam for the morning

- Limiting alcohol and salty foods before the exam

- Getting a good night’s sleep before the exam

- Skipping your exercise routine the morning of your exam

- Take your medications.

Bundle Branch Block Life Insurance

Right bundle branch blocks (RBBB) and Left bundle branch blocks (LBBB) are common.

A right bundle branch block is a common abnormal EKG irregularity.

It doesn’t pose a problem with underwriting unless just discovered as part of your paramedical exam for life insurance.

A left bundle branch block, on the other hand, raises concerns because it may interfere with EKG readings and hide an underlying heart issue such as:

- Cardiomyopathy

- Coronary artery disease

- Left ventricular hypertrophy

Suppose your doctor discovered a bundle block during the life insurance application.

In that case, some life insurers may postpone or decline your application until your cardiologist evaluates you.

Life insurance rates are based on any underlying heart condition if you’ve had a cardiac workup completed.

If no other heart issues are present, it may be possible to obtain the best rates or a slight rating for some cases.

Life Insurance for Angina

Angina (angina pectoris) is chest pain that occurs when there is a decrease in the blood oxygen supplied to your heart.

It usually occurs after exertion, cold weather, stress, and sometimes after a heavy meal.

An estimated 9 million Americans have angina.

You may have been diagnosed with angina from:

- Having chest pain symptoms

- Electrocardiogram

- Stress test

- Cardiac catheterization

- Cardiac MRI

- Coronary CT scan

- Have chest pained symptoms?

Underwriters look for other heart conditions such as:

- Coronary artery disease

- Aortic stenosis

- History of heart stents

- Other heart conditions

Life insurers tend to postpone coverage for six months after diagnosis and longer if you suffer from unstable angina.

From an underwriting and price standpoint:

- Age 65 or older – Table Rating 2 – Table Rating 3

- Under Age 65 – Table Rating 4

Life insurance rates are better for those with stable angina.

Underwriting is based on all medical issues if you have other heart conditions.

Aortic Stenosis Life Insurance

With stenosis, your valve thickens and does not open properly.

The stenosis may come from congenital heart conditions, rheumatic fever, or aortic valve calcification.

Doctors diagnose stenosis via an echocardiogram or by cardiac catheterization.

Aortic stenosis categories:

- Trace or Trivial or Minimal

- Mild

- Moderate

- Severe

Valve pressure between your aorta and left ventricle determines your gradient.

A cardiac catheter provides a definitive diagnosis, while an echo provides an estimate.

Your Gradient and the heart murmur grade determine a trace, mild, moderate, or severe aortic stenosis.

Life Insurance Rates by Aortic Stenosis Severity

- Trace – Standard life insurance rates for age 60 or older – table 2 rating for younger insureds.

- Mild – Standard rates – Table ratings 2-3 for 60 or older. Table 3-4 for younger insureds.

- Moderate—Table rating 2-4 for people 60 or older. Table rating 4 or greater for younger insureds.

- Severe – It is complicated to underwrite for term, universal, and whole life insurance cases. Guaranteed issue life insurance may be an option.

We’ll let you know what to expect in terms of price based on your stenosis history.

Heart Murmur Life Insurance

Many people may only learn about a murmur after a heart check with a stethoscope.

Heart murmurs are either functional heart murmurs or organic heart murmurs.

Functional heart murmurs are also called innocent heart murmurs and are a minor concern to life insurance underwriters.

Functional types include physiologic, cardiorespiratory, and aortic sclerosis murmurs. They are not a problem if there is no other underlying heart issue.

Organic Heart Murmurs – are caused by heart disease or congenital problems.

Types of organic include:

- Aortic Insufficiency

- Aortic Stenosis

- Bicuspid Aortic Valve problems

- Insufficiency of Mitral Valve

- Stenosis of Mitral Valve

- Mitral Valve Prolapse

- Pulmonary Insufficiency

- Pulmonary Stenosis

The type of organic murmur you have determines underwriting outcomes.

Final Thoughts

We have specialized in underwriting heart problems since 1998, helping thousands of clients get affordable life insurance.

You may be wondering how your condition will affect your life insurance policy.

The good news is that many insurers offer policies to people with pre-existing conditions like heart disease.

Some insurers specialize in covering high-risk individuals.

Request your free, no-pressure, no-obligation life insurance quote today.