Chances are you won’t die from an accident…but what if you did?

Accidental death insurance pays a benefit if your demise happens from an accident.

This guide tells you when and why you may (or may not) want accidental death coverage.

Accidental Death Overview

This article tells you when you should consider this type of insurance.

What is Accidental Death Insurance?

This type of insurance is not term life insurance. It’s insurance that only pays in the event of your death from an accident.

There are also accidental death & dismemberment (AD&D) policies that pay benefits in the event of loss of limbs, etc.

Death from Accidents

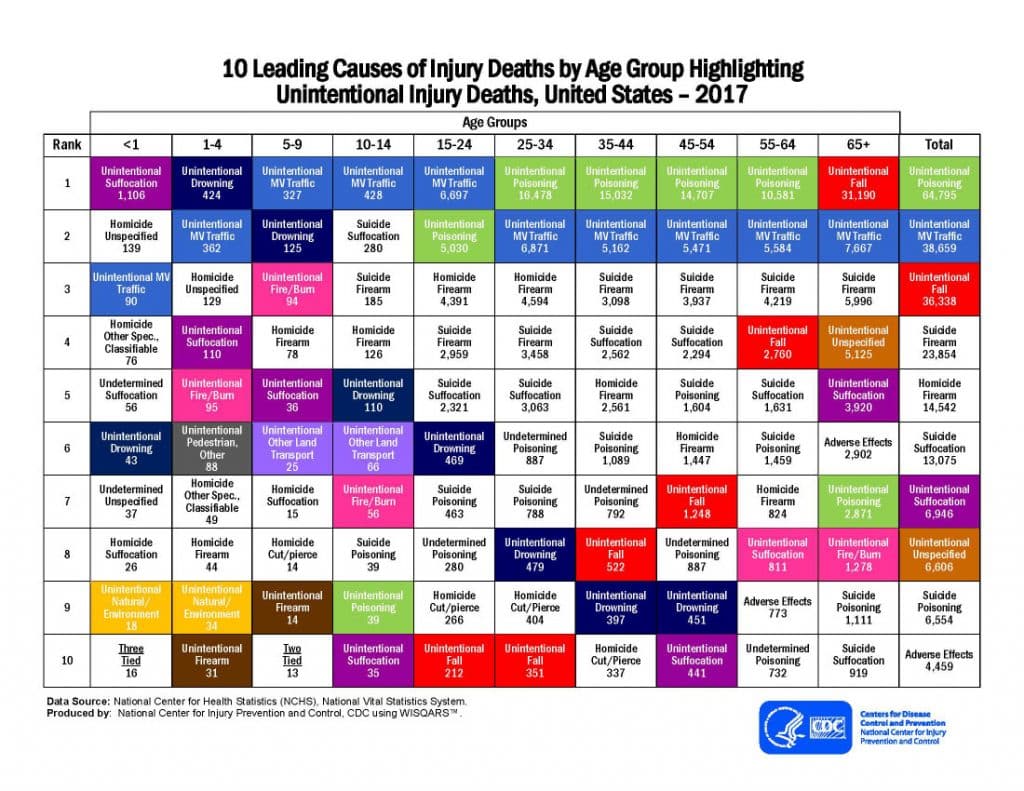

How likely is it that you will kick the bucket from an accident? We went to the source for the answer. The CDC.

The Centers for Disease Control and Prevention (CDC) tracks unintentional deaths by age and type of accident. They’re useful statistics for the life insurance industry.

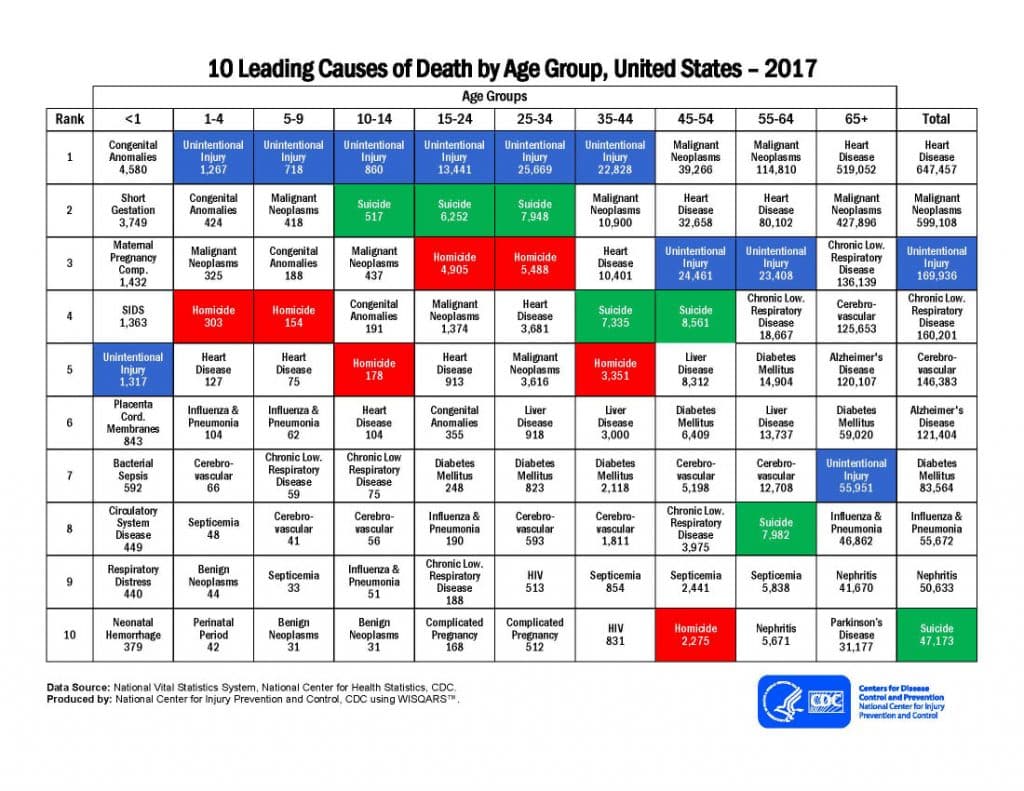

If you’re wondering how unintentional deaths compare to all deaths by age…the CDC tracks this information, too:

So why buy accidental coverage if you’re more likely to die from an illness?

Accidental Death Pros

We work with many people who are not insurable due to a high-risk health condition,

Or, because life insurance is so expensive, it leaves them underinsured and unable to provide the amount of life insurance needed.

When life insurance is not available, accidental provides some coverage for the insured’s beneficiary.

Features/Benefits:

- No underwriting or waiting for medical records to arrive.

- No paramedical exam is required.

- Easy to qualify for

- An inexpensive way to get coverage

- Fast – Policy approvals in 10 days or less are common

- Policies may include a dismemberment provision

- Policies may cover war and terrorism deaths

- Presumption of death in certain instances.

You may purchase a policy separately,

Or, some companies offer accidental death as a policy rider on term life, whole life, and universal life insurance.

Tobacco User? You’ll be happy to know that rates for cigar, chewing tobacco, cigarette smokers, and pipe tobacco users are the same as those who don’t use tobacco products.

Accidental Death Cons

Accidental death policies come with exclusions, and they won’t pay death benefits if you die from one of them.

Common exclusions include:

- Death from any health issue

- Coverage may be limited to 10x your income.

- Many policies exclude war, whether declared or undeclared.

- Many policies exclude terrorism for victims.

- Suicide

- Serving in the armed forces

- Committing a felony

- Being intoxicated or accidents related to intoxication

- Death while being under the influence of drugs – i.e., marijuana

- Death from private aviation

- Reckless driving or engaging in contests of speed

- Rates are level for 5-year increments. Compare that to the 40-year term available with companies.

Make sure that the accidental policy will meet your needs.

Accidental policies for seniors are limited or unavailable with many companies.

Recent Articles:

Life Insurance 101: Your Complete Guide

What You Need to Know About 500k Life Insurance with No Medical Exam

How much does a million-dollar life insurance policy cost?

It’s Never Been Easier to Get $1,000,000 How Much is a Million Dollar Life Insurance…

Life Insurance for Foreign Nationals: How Non-U.S. Citizens Get Coverage

Maximize Your Pension with Life Insurance – A Complete Guide

How is Survivorship Life Insurance Helpful in Estate Planning?

Why Consider Accidental Death Insurance?

Buy a life insurance policy whenever possible,

But if accidental is the only realistic option, it’s worth considering as it provides some coverage.

Life insurance is preferable because it covers you in the event of death from a health reason or an accident.

When we discuss your life insurance needs with you,

We’ll tell you what to expect regarding underwriting and price for traditional and accidental coverage.

When no other option is available, we’ve had lenders accept accidental death with a collateral assignment for business loan purposes.

It can even be used for key person life insurance if no other options are available.

How Does Accidental Death Insurance Work?

Underwriting is fast and easy and does not require medical underwriting.

The applications are straightforward, and many can be e-submitted online.

It typically takes about 7-10 days to complete the entire process.

If you want to compare that to the traditional life insurance underwriting process, look at our guide – Life Insurance 101.

FAQ

You have questions about accidental death insurance, and we have the answers.

Final Words

Accidental insurance isn’t perfect, but it is a great option when you are uninsurable or the price makes life insurance too expensive.

Please take a few minutes to submit your quote request. Thank you.