Life insurance is a great idea, but that is just the beginning.

Whether you apply for a no exam policy or a fully underwritten one requiring a paramed exam, you still have other decisions.

When you set up your policy, you also decide how the beneficiary receives the proceeds.

So, how do you choose the right life insurance settlement option for the death benefit payout?

Life Insurance Settlement Options

Make sure you choose carefully, as your decision may be irrevocable.

The five most common life insurance settlement options:

Lump-Sum Payout

Most people who buy life insurance will designate their beneficiary and not give it another thought.

That’s perfectly fine to do.

Life insurers would pay the death benefit as a lump sum unless another option were previously chosen.

Depending on how much life insurance you buy, another option for you to consider is how the beneficiary receives the proceeds.

I don’t know what the statistics say, but in our experience, lumpsum is the most common settlement option for accidental death, term life, universal, and whole life policies.

A lump-sum payout pays the full death benefit to the beneficiary in one payment.

This is always the best option for key person life insurance and SBA life insurance policies used in business cases.

The beneficiaries may spend the money as they see fit.

If you must have life insurance as part of a divorce decree, the lump sum option is probably best unless another option was agreed to.

But what if you are concerned about how the money will be spent?

Maybe a lump sum isn’t the best option for your beneficiary.

If that’s the case, take a look at these settlement options.

Recent Articles:

Seniors: Compare Our Life Insurance to Your AARP Coverage!

Replacing Life Insurance in New York

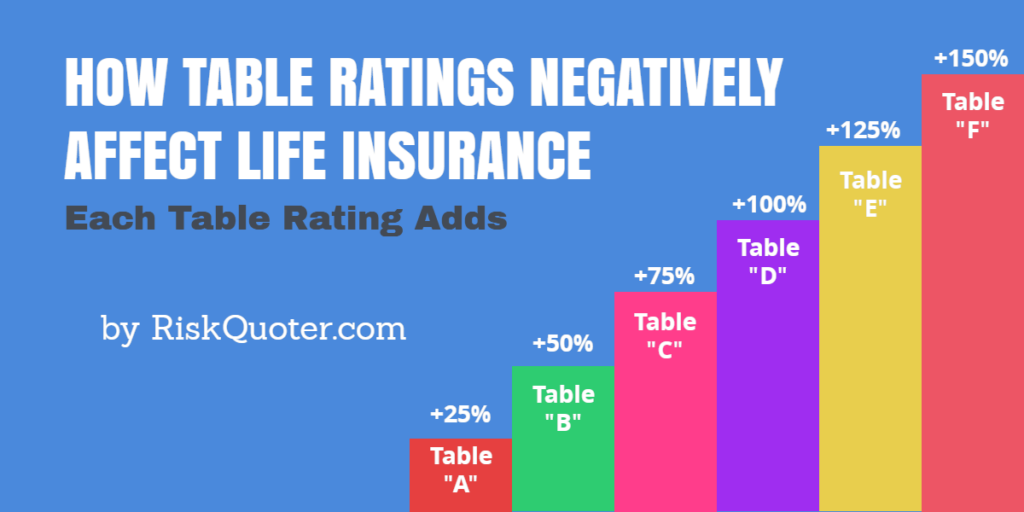

Get the Best Life Insurance Table Rating for Your Situation

Top 10 Health Problems in America

Cigar Smokers Never Pay Smoker Life Insurance Rates!

Kidney Cancer Survivors – Life Insurance is Available!

Fixed Income Option Insurance Settlement

A fixed income option insurance settlement is also known as a fixed period settlement, where the death benefit proceeds are paid to the beneficiary over time.

That timeframe can be 1-25 years, depending on the company.

Even group policies or niche products like the Costco or AICPA life insurance program offer different settlement options.

Most companies pay the benefit monthly to the beneficiary.

Payments will include interest in the 0.75 – 1.5% range.

The death benefit received is still tax-free.

The interest earned will be taxable, similar to if you had put the money in the bank.

When should you consider installments for a fixed period?

If you want to make sure the proceeds will last for a while,

Or, if you have concerns about the beneficiary burning through the money too quickly, the fixed-income option may be a good choice.

It may also be a good idea to buy life insurance to replace a pension benefit for your spouse.

Life Income Settlement Option

The life income settlement option provides your beneficiary with a monthly income for as long as they live.

The beneficiary will receive the income for as long as they live.

If you bought the life insurance for your spouse and wanted to ensure the proceeds lasted, this may be an option to consider, especially if they are seniors living on their own.

Policies have “settlement options tables” that list the monthly income based on the age and gender of the beneficiary.

Sample monthly payment for a $100,000 insurance policy.

| Age | Female | Male |

|---|---|---|

| 40 | $322 | $347 |

| 50 | $361 | $383 |

| 60 | $424 | $456 |

| 70 | $533 | $578 |

| 80 | $712 | $749 |

| 90 | $888 | $898 |

While each life insurance company may offer slightly different payments, they all tend to be very similar.

Some companies offer a joint and survivor life income that pays benefits for two people’s lifetime.

When the recipient dies, no further payments are made.

What happens if the full death benefit has not been paid out?

Companies offer a specific (guaranteed) period option that ensures payments for “x” years.

The second option is an “Installment Refund” option that pays out the remaining death benefit.

Interest Payments

With interest payments, the insurance company holds onto the death benefit.

You can restrict the beneficiary’s access to the full death benefit until they reach an age you determine.

The beneficiary receives the interest earned until they reach the age you set.

At that time, the beneficiary can receive the full death benefit.

You may consider this option if your beneficiary is a minor and you have no one else to monitor the funds.

Fixed Amount Settlement

You can choose to have your beneficiary receive a certain amount each year.

The payments can be made annually, semi-annually, quarterly, or monthly.

The insurance company will pay this amount until all insurance proceeds are paid.

The death benefit held by the life insurer earns interest.

Who Chooses the Settlement Option?

Who gets to choose how the beneficiary gets paid?

During the insured’s lifetime, the owner may elect any payment option.

If the owner selects the payment option for the beneficiary, the beneficiary may not:

- Change the election

- Assign the money held by the insurer

- Withdraw any future installments

Once payments start, the option can’t be changed.

Beneficiary Elects Payment Option

If no option were chosen, the insurance company would give the beneficiary the option of choosing how to get paid.

The beneficiary may elect a lump sum or one of the other options available.

If the policy is collaterally assigned for a bank loan, the assignee’s death benefit portion is paid in a lump sum.

Final Words

While most death benefits are paid in a lump sum, knowing you have options is good.

It’s far better than relying on a GoFundMe life insurance campaign.

You should also check the policy for any life insurance riders that may be included.

The reason is that additional benefits/options may be available to you.

If you need additional information on the overall life insurance process, our life insurance 101 guide offers an excellent overview.

At RiskQuoter, we offer term policies with durations from 1 to 40-year terms.