Don’t let a colon cancer diagnosis stop you from securing life insurance. It’s absolutely possible, even if it seems daunting.

Here’s the lowdown:

You may think that buying life insurance after you’ve been diagnosed with colon cancer is out of the question.

However, that’s not necessarily true. With a bit of research and planning, getting affordable life insurance after a colon cancer diagnosis from companies specializing in high-risk life insurance is possible.

Colon Cancer and Life Insurance: What You Need to Know

Colorectal cancer is a relatively common gastrointestinal cancer, mainly affecting older people.

This cancer consists of colon cancer (large intestine) and rectal cancer (the last few inches of the colon).

The way that colon cancer affects your life insurance depends on many factors, including:

- Your age at the time of diagnosis

- The type of cancer you were diagnosed with

- Colon cancer stage

- Treatment received

- Time since completion of therapy

- Any history of recurrence

People diagnosed with colon cancer after age 65 receive more favorable rates than those diagnosed under age 65.

From an underwriting perspective, rectal and colon cancer follow similar underwriting guidelines.

Key Questions Insurers Ask About Your Colon Cancer

Life insurers need to know the following:

- When were you diagnosed with colon cancer?

- What stage was colon cancer?

- What grade was the colon cancer?

- Were any lymph nodes involved? If yes, how many and what location?

- Did cancer spread to any other organs? Where did it spread?

- What type of treatment did you receive? Surgery, chemo, radiation?

- What were the start and finish dates of all treatments?

- Has there been any recurrence?

- Have you completed all the follow-ups with your physician?

- When was your last colonoscopy, and what were the results?

- What was your CEA level, if known?

- Is there any family history of colon cancer with your parents or siblings?

- Have you had any other health issues in the past or currently?

The best insurers for life insurance after cancer depend on your history and current health.

Other factors affecting your life insurance rates include any history of other medical conditions such as irritable bowel diseases or elevated liver functions.

If you’ve had other health conditions like heart disease, atrial fibrillation, cancer, epilepsy, diabetes or any other health issue, we can help you.

Life Insurance After Colon Cancer: What to Expect

The good news is that life insurance options for colon cancer survivors are improving. Your chances of getting coverage, and at what cost, depend largely on your cancer stage and age at diagnosis:

- Age 65 or Older – You’re more likely to find favorable rates and easier approval.

- Early Stages (0 and 1) – Standard rates are possible within a year of treatment.

- Stage 2 – You might face a waiting period of 1-5 years, and your rates may be higher.

- Stage 3 – Coverage is still possible, but longer waiting periods of 5-10 years are likely.

- Stage 4 – Options are limited to guaranteed issue policies.

Life insurance underwriting for colon cancer survivors continues to improve, with several carriers now offering affordable life insurance.

You’ll find more detailed information in the following sections.

Colon Polyps and Your Life Insurance

Most colon polyps are harmless, but some types (like adenomas) can develop into colorectal cancer. Here’s what you need to know:

- Benign Polyps: If the removed polyp is not cancerous, your life insurance will not be affected.

- Cancerous Polyps: If the polyp is cancerous, your application will follow the underwriting rules based on the cancer stage and treatment.

Suppose the removed polyp’s pathology shows it’s benign.

Then, your life insurance would not require an additional rating.

If the polyp is cancerous, underwriting follows colon cancer rules.

Finding Coverage with Stage 0 Colon Cancer

The innermost lining or mucosa layer contains abnormal cells.

These abnormal cells may become cancerous.

Getting life insurance at a “standard” rate within 12 months of completing treatment is now possible.

The same ratings apply whether you were diagnosed before or after age 65.

Life Insurance After Stage 1 Colon Cancer Diagnosis

Stage 1 colon cancer has spread beyond the innermost layer of your colon to the middle layers of the colon wall.

There is no lymph node involvement.

Life insurers will postpone offering life insurance for 12-24 months.

When life insurance is available, carriers will consider their “standard” rates and an expense called a flat extra.

Flat extras are temporary and add $500 – $750 per every $100,000 coverage you buy.

Options for Life Insurance with Stage 2 Colon Cancer

Stage 2 colon cancer has spread into the outer layer of the colon wall and, in some cases, may have spread to nearby tissue or other organs.

No lymph nodes are involved.

Stage 2 colon cancers – Stage 2A, Stage 2B, or Stage 2C.

Stage 2A Colon Cancer

Postpone periods run 12-24 months after completing all treatment, with insureds age 65 and older receiving coverage after 12-month postponements1.

Once the postponement period is over, life insurers will consider their standard rates plus a flat extra expense of $750 – $1000 per every $100,000 coverage you purchase.

Stage 2B Colon Cancer

Postpone periods tend to run 24-60 months after completing treatment.

Flat extra expenses will typically be $1000 or more per every $100,000 coverage you consider.

Stage 2C Colon cancers follow the underwriting rules for Stage 3 colon cancers.

Life Insurance Options for Stage 3 Colon Cancer

Cancers have spread to at least one lymph node, depending on whether the tumor is stage 3A, 3B, or 3C.

The best-case scenario is typically a 5-year postponement (2 years for age 65+).

The best case means two or fewer lymph nodes and a normal CEA level.

Once coverage is available, offers will include a permanent table rating.

And flat extra expenses of $1000 per every $100,000 of coverage are common.

In our experience, most stage 3 colon cancers will receive a postponed period of 10 years or longer due to the severity of the tumor.

A guaranteed issue life insurance policy may be the best option initially.

Is Life Insurance Possible with Stage 4 Colon Cancer?

The only option for stage 4 colon cancer is a guaranteed issue life insurance policy.

With this policy, the first few years of the policy have a graded death benefit.

Our Expert Service: Guiding You Through the Process

Life insurance companies have criteria for underwriting colon cancer, and underwriting offers vary widely.

With our quick quote process, we’ll gather your detailed medical history from you.

We then shop out to life insurance companies anonymously for feedback.

It takes about three days to hear from all the companies.

At that time, we’ll review quotes with you and help you decide on the type of life insurance and the amount of life insurance to consider.

If you change your mind anytime, tell us to close your file.

There is never any pressure or obligation with our service.

Colon Cancer Terms and Definitions

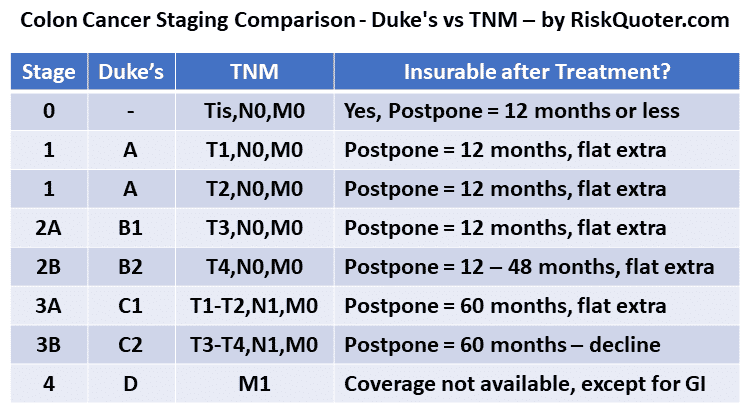

Colon cancer is classified according to a cancer staging system using either Duke’s Colon Cancer Staging or the TNM cancer staging system.

TNM staging is the current cancer staging system used. However, you may see Duke’s system on older pathology reports.

TNM cancer staging system uses numbers and letters to indicate the extent of colon cancer:

A comparison of TNM Staging to Duke’s:

“T” stands for the size and stage of the cancer tumor.

“N” Indicates the number of lymph nodes involved.

“M” indicates if cancer has spread (metastasized).

In addition to the TNM classification of colon cancer, pathology will indicate if the colon cancer was:

- Adenocarcinoma (the most common type)

- Carcinoid tumor

- Stromal Tumor

Colon cancer grade indicates how quickly cancer may grow.

Colon cancer grades:

- Well Differentiated (Low Grade)

- Moderately Differentiated (Intermediate Grade)

- Poorly Differentiated (High Grade)

Underwriting uses the highest grade when the pathology report lists multiple cancer grades.

Please take a few minutes to complete your no-pressure, no-obligation quote request today.

- 2024 – Prudential – Rx for Success – Colorectal Cancer ↩︎