As a licensed insurance agent, I bought the Colonial Penn $9.95 plan to see what it’s like firsthand. Here’s my review from both a customer and agent perspective.

- Colonial Penn $9.95 Overview

- What Exactly is Colonial Penn's $9.95 Plan? (And Is It Right for You?)

- My Colonial Penn $9.95 Application Experience

- Colonial Penn $9.95 Life Insurance Chart

- How Do Colonial Penn Rates Compare to Competitors?

- Is Colonial Penn Good for Healthy People?

- Is Colonial Penn a Legitimate and Reputable Life Insurance Company?

- Colonial Penn Negative Reviews

- Is Colonial Penn Deceptive or Misleading?

- Your Acceptance is Guaranteed

- Final Thoughts

Colonial Penn $9.95 Overview

This review is unique because it’s written by a licensed insurance agent who bought a Colonial Penn policy. The $.9.95 plan is the senior life insurance you often see advertised on TV.

This is the first life insurance company review completed by a licensed insurance agent who bought a Colonial Penn policy.

The spokesperson, Jonathan Lawson, emphasizes the Three P’s of Colonial Penn:

It’s a simple message that resonates with consumers—so much so that Colonial Penn’s parent CNO reported almost $937 million in traditional life revenue in 2023!

What Exactly is Colonial Penn’s $9.95 Plan? (And Is It Right for You?)

The Colonial Penn $9.95 plan is a Modified Benefit Whole Life Plan with:

- Limited benefits during the first two years for non-accidental deaths (premiums plus interest refunded)

- Full benefits for accidental deaths

- Full death benefits paid for deaths after the second year

- Premiums payable to age 100

- Policy maturity at age 121

- Policy Loans are available

- Non-Forfeiture Benefits

While policy loans are available, they are offset by the cash value or death benefit when you die. If you lapse a policy with a loan, you may end up getting a tax bill.

Non-forfeiture benefits give you the following options if you stop paying premiums:

- Extend the policy as term life insurance for a limited time.

- Get a paid-up life insurance policy at a lower face amount than the policy you bought.

- Surrender the policy for its cash surrender value

Policy pages include charts that indicate the amount of extended-term life, paid-up insurance, and cash surrender value.

You’ll find articles throughout our blog about companies and benefits available such as long-term care insurance benefits – Something that Colonial Penn does not offer.

Important Note About Two Year Waiting Periods

Many believe a two-year waiting period is their only option, but there are Day 1 coverage options available even with health conditions like:

Companies that offer Day 1 coverage:

Consider the amount of life insurance you need, as Colonial Penn is limited compared to the above companies that offer more coverage for a better price.

People Also Ask

We have answers if you have questions about the Colonial Penn $9.95 plan!

My Colonial Penn $9.95 Application Experience

Applying online is simple. Here’s what I did:

- Provided my personal information.

- Chose my coverage amount.

- Provided beneficiary details.

- Answered questions about policy replacement and payment details.

You can also complete your application over the phone if you like.

That’s all there is to it. It’s simple to complete and takes about 10 minutes and you’ll receive a confirmation email that looks like this.

I received a confirmation email from Colonial Penn within minutes.

About a week later, I received my policy in the mail.

I know from my own experience as an agent working with seniors that one of their biggest concerns is not to be a burden on their loved ones if they die.

Colonial Penn nails this better than 99% of the insurance companies out there!

If my Colonial Penn $9.95 life insurance review ended right now, I would tell you that it is a simple and easy-to-use process for seniors.

Colonial Penn $9.95 Life Insurance Chart

The real questions begin with – What are you getting for your money, and how does Colonial Penn compare to other life insurance companies?

Colonial Penn sells life insurance by unit – You can buy 1-15 units.

The amount of life insurance you get per unit depends on your age & gender. The older you are, the less life insurance you receive per unit. Women receive more life insurance per unit than men.

Colonial Penn $9.95 Chart by Age

Here’s how much life insurance you get per $9.95 unit, based on gender and age.

The first two columns show the life insurance amount per Colonial Penn unit. The second two columns convert this to a rate per $1,000 of coverage, making it easier to compare with other companies.

| Age | Female Life Insurance Per Unit | Male Life Insurance Per Unit | Female Monthly Rate Per $1,000 of Life Insurance | Male Monthly Rate Per $1,000 of Life Insurance |

|---|---|---|---|---|

| 50 | $2,000 | $1,669 | $4.98 | $5.96 |

| 51 | $1,942 | $1,620 | $5.12 | $6.15 |

| 52 | $1,890 | $1,565 | $5.26 | $6.36 |

| 53 | $1,845 | $1,515 | $5.39 | $6.57 |

| 54 | $1,802 | $1,460 | $5.52 | $6.82 |

| 55 | $1,761 | $1,420 | $5.65 | $7.01 |

| 56 | $1,719 | $1,370 | $5.79 | $7.26 |

| 57 | $1,669 | $1,313 | $5.96 | $7.58 |

| 58 | $1,620 | $1,258 | $6.14 | $7.91 |

| 59 | $1,565 | $1,200 | $6.36 | $8.29 |

| 60 | $1,515 | $1,167 | $6.57 | $8.53 |

| 61 | $1,460 | $1,112 | $6.82 | $8.95 |

| 62 | $1,420 | $1,057 | $7.01 | $9.41 |

| 63 | $1,370 | $1,000 | $7.26 | $9.95 |

| 64 | $1,313 | $949 | $7.58 | $10.48 |

| 65 | $1,258 | $896 | $7.91 | $11.10 |

| 66 | $1,200 | $846 | $8.29 | $11.76 |

| 67 | $1,167 | $802 | $8.53 | $12.41 |

| 68 | $1,112 | $762 | $8.95 | $13.06 |

| 69 | $1,057 | $724 | $9.41 | $13.74 |

| 70 | $1,000 | $689 | $9.95 | $14.44 |

| 71 | $949 | $657 | $10.48 | $15.14 |

| 72 | $896 | $627 | $11.10 | $15.87 |

| 73 | $846 | $608 | $11.76 | $16.37 |

| 74 | $802 | $578 | $12.41 | $17.21 |

| 75 | $762 | $549 | $13.06 | $18.12 |

| 76 | $724 | $521 | $13.74 | $19.10 |

| 77 | $689 | $493 | $14.44 | $20.18 |

| 78 | $657 | $468 | $15.14 | $21.26 |

| 79 | $627 | $441 | $15.87 | $22.56 |

| 80 | $608 | $426 | $16.37 | $23.35 |

| 81 | $578 | $424 | $17.21 | $23.47 |

| 82 | $549 | $423 | $18.12 | $23.52 |

| 83 | $521 | $421 | $19.10 | $23.63 |

| 84 | $493 | $420 | $20.18 | $23.69 |

| 85 | $468 | $418 | $21.26 | $23.80 |

For example:

Compare Prices from Other Companies

Example 2 – Male age 55 buys 15 units x $9.95 = $149.25 per month.

$1420 (from above chart) x 15 = $21,300 of Colonial Penn life insurance.

That same $149 per month with Protective Life buys $125,000 guaranteed to age 121.

How Do Colonial Penn Rates Compare to Competitors?

Now that we have the rate per $1,000 pricing above, it’s much easier to compare Colonial Penn to other companies.

Below is a comparison of graded benefit policies between Colonial Penn, Mutual of Omaha and Transamerica

Female Graded Benefit Monthly Rates:

| Age | Female Colonial Penn Rate Per $1,000 of Life Insurance | Female Mutual of Omaha Rate Per $1,000 of Life Insurance | Female Transamerica Rate Per $1,000 of Life Insurance |

|---|---|---|---|

| 50 | $4.95 | $3.23 | $7.72 |

| 55 | $5.65 | $3.90 | $8.71 |

| 60 | $6.57 | $4.38 | $9.76 |

| 65 | $7.91 | $5.08 | $11.63 |

| 70 | $9.95 | $6.38 | $14.00 |

| 75 | $13.06 | $8.69 | $17.03 |

| 80 | $16.37 | $12.17 | $23.33 |

Male Graded Benefit Monthly Rates:

| Age | Male Colonial Penn Rate Per $1,000 of Life Insurance | Male Mutual of Omaha Rate Per $1,000 of Life Insurance | Male Transamerica Rate Per $1,000 of Life Insurance |

|---|---|---|---|

| 50 | $5.96 | $4.16 | $9.03 |

| 55 | $7.01 | $4.65 | $10.59 |

| 60 | $8.53 | $5.73 | $12.14 |

| 65 | $11.10 | $6.81 | $15.09 |

| 70 | $14.44 | $8.52 | $19.16 |

| 75 | $18.12 | $11.00 | $24.61 |

| 80 | $23.35 | $15.09 | $34.91 |

Bottom Line – Mutual of Omaha has much better pricing and Transamerica’s pricing is worse than Colonial Penn.

We also have many other companies to compare, including AIG-Corebridge Financial, Great Western, Transamerica, and others.

Is Colonial Penn Good for Healthy People?

No, definitely not!

Don’t buy a graded policy when you’re healthy. You will qualify for an underwritten policy that provides a greater death benefit at a lower premium.

Age 65 example:

With Colonial Penn, the maximum amount of life insurance available is:

- Females – 15 units x $1258 = $18,870 of life insurance for $118.65 per month

- Males – 15 units x $896 = $13,440 of life insurance for $166.50 per month.

You can buy a level final expense policy with Corebridge, Mutual of Omaha, Transamerica, Encova, and Royal Neighbors and get $25,000 of coverage for less than the above amounts with Colonial Penn!

But that’s not even the best deal around for healthy people.

You can buy a guaranteed universal life insurance policy and get $25,000 of coverage for $87 per month for males and $79 per month for females.

You can get $50,000 of coverage guaranteed to age 121 for $140 per month for males and $126 per month for females.

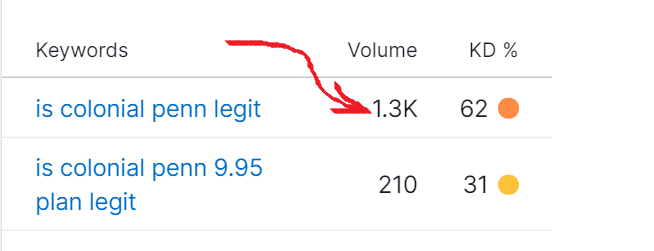

Is Colonial Penn a Legitimate and Reputable Life Insurance Company?

You’re not alone if you are asking this question about Colonial Penn.

According to our keyword research tools, this question gets asked 1,300 times per month!

Colonial Penn is owned by CNO Financial Group, which has $35.1 billion in assets and $937 million in life insurance premiums in 2023.

The company was founded by AARP founder Leonard Davis.

The company has a mix of positive and negative reviews, with common complaints about the limited benefits during the first two years, and the $9.95 life insurance amount.

Financial Strength Ratings

According to CNO’s website, financial strength ratings as of 10/16/2024 are:

- AM Best – “A”

- S&P – “A-“

- Fitch – “A”

- Moody’s – “A3”

Ratings are subject to change.

Colonial Penn Negative Reviews

Colonial Penn has its share of negative reviews with the Better Business Bureau.

However, some people have had positive experiences with Colonial Penn.

If nothing else, the sheer volume of its advertising has raised awareness about the need for life insurance.

When you read through some reviews, the common theme seems to be the limited benefits during the first two years and the amount of life insurance that $9.95 buys you.

Colonial Penn is the only company we know of that charges by the unit rather than charging based on the amount of life insurance. It leads to lots of confusion.

Is Colonial Penn Deceptive or Misleading?

If you complete a Google search asking if Colonial Penn uses deceptive or misleading advertisements, you’ll see plenty of articles about that topic.

Here’s the thing – All insurance companies, including Colonial Penn, are subject to insurance department regulations in every state.

Bottom Line: The “unit” system of selling life insurance makes it difficult for consumers to compare Colonial Penn to other companies.

Your Acceptance is Guaranteed

If you listen to commercials or read the website, you’ll see and hear “your acceptance is guaranteed” throughout.

In our experience, many people think that a guaranteed acceptance policy is the only option until they learn from us that high-risk health issues like diabetes, cancer history, or heart disease are readily insurable with traditional life insurance.

You may qualify for a policy that provides immediate death benefits.

The advantage of fully underwritten life insurance is that you can get more coverage for less money than a graded benefit final expense policy.

Even if you’ve already purchased a policy elsewhere, let us show you how our companies compare. There is no pressure or obligation with our service.

Final Thoughts

Colonial Penn offers a convenient way to purchase small life insurance policies that do not require medical underwriting.

The pros are that coverage is easy and convenient, and the cons are that the unit pricing may be confusing when compared to other companies.

Take a few minutes to request your quote request today. There is never any pressure or obligation with our service.