Find the perfect pilot life insurance plan for private or commercial aviation!

- Pilot Life Insurance: What You Need to Know

- Underwriting Examples

- Understanding Underwriting for Pilots

- Private Pilots

- Student Pilots

- Commercial Pilots

- Cargo Pilots

- Military Pilots

- Flat Extras and Aviation Exclusions: The Details

- Aviation Occupations

- Comparing AOPA Insurance to Individual Options

- FAQ

- Final Thoughts

Pilot Life Insurance: What You Need to Know

Whether you are involved with commercial or private aviation, great companies can help you.

We’ve made extensive updates to give you the latest information available for 2024.

Some of the benefits of working with us include:

- Affordable Life Insurance

- Many companies available

- Term, universal & whole life available

- We minimize/eliminate flat extras

- Aviation exclusion is available

- Underwriting Expertise with

- Student pilots

- Private pilots

- Commercial pilots

- Instructors

- Military

- Crop spraying

- Fire fighting, air ambulance

- Company Independence

- We work for you, not the insurance company!

- 40+ companies available

And of all those companies, only a handful do a great job providing life insurance for pilots.

We make sure you get to those companies. Compare that to an agent who only represents one company.

Underwriting Examples

Here are some great examples of life insurance offers that we obtained for pilots.

Private Pilot Example

Two Years of Flying Experience

- Last Year – 15 Hours

- This Year – 10 Hours

- Total Hours – 90

- Training for IFR and Multi

Best Offer – Corebridge Financial

Rate: Standard Plus – No Flat Extra

Student Pilot Example

Started flying this year

- Last Year – 0 Hours

- This Year – 5 Hours

- Total Hours – 5

- Full Coverage, No Exclusions

Best Offer – Protective Life

Rate: Standard – No Flat Extra

Keep reading to get the full details about pilot insurance coverage.

Understanding Underwriting for Pilots

Life insurance underwriting for pilots depends on several factors, including:

- The type of pilot (private, commercial, military, etc.)

- Pilot ratings

- Total hours flown

- Annual hours flown

- Type of aircraft

- Type of flying.

The best high-risk life insurance for pilots depends on your individual information.

One of our goals when helping pilots is to eliminate or minimize any flat extra expense you may have encountered elsewhere.

Private Pilots

More companies become available once you’ve earned your private pilot’s license (PPL).

Your total hours, average hours per year, and whether you have an instrument flight rating (IFR) are primary factors in underwriting.

Underwriting wants to know about:

- What type of license do you have?

- What aircraft class rating do you have?

- Do you have your instrument flight rating (IFR)?

- What is the make and model of the aircraft you fly?

- How much time have you had in this aircraft?

- When did you obtain your PPL?

- How many hours do you have:

- In total?

- Last year?

- This year?

- Expected hours next year?

- Do you expect to change the aircraft you fly in the next two years?

- Have you ever had any FAA violations?

Most companies look for a minimum of 300-500 total hours and an annual average of 26-300 hours per year to consider an offer without a flat extra expense.

Some companies are more lenient with total hours (AIG is 100) if you have an IFR.

When you average 150-300 hours per year, many companies will add a flat extra to your rate, and if you exceed 300 per year, almost all companies will add the flat extra.

Student Pilots

Life insurance for student pilots typically requires a flat extra expense of $250 – $500 for every $100,000 coverage you buy.

The difference between companies is the medical rate class available.

While many life insurers offer only a standard or standard plus rate, a few will consider a preferred (John Hancock) and even a preferred elite (AXA) rate.

Most companies use total flying hours as the basis for determining your rate.

100 Hours

100 total hours seems to be the magic number where your offers improve.

So even if you have received your sport/recreational or private pilot certificate, but your total hours are less than 100, you may still be rated like a student pilot.

When you reach 100 total hours, we should re-shop your coverage to see if better offers are available.

What if You Haven’t Started Flying Yet?

How does underwriting work if you decide to start flying but haven’t started your lessons yet?

The simple answer is that you will be underwritten as a student pilot. Here’s why.

Life insurance companies are all too familiar with this scenario, so they ask about your aviation history and intentions.

Here’s the aviation question by company:

| Life Insurance Company | Questions |

|---|---|

| Banner Life | Asks if you have activity or plan to in next 6 months. |

| Cincinnati Life | Past 2 years or plans to fly. |

| Corebridge | Past 5 years or plans in the next 2 Years |

| John Hancock | Have you ever flown or plans in next 2 years |

| Lincoln National | Past 2 years or plans in next 2 years. |

| Minnesota | Last 5 years or plans in next 2 years |

| Nationwide | Past 2 years or plans in next 12 months |

| North American | Past 2 years or plans in next 2 years |

| Pacific Life | Past 2 years or plans in next 2 years |

| Protective Life | Past 2 years or plans in next 2 years |

| Prudential | Past 5 years or plans to become pilot |

Commercial Pilots

If you fly passenger airlines for a living, most life insurers will offer you their best rate classes, provided you qualify medically.

Basic criteria include:

- Age 30 or older

- Minimum of 1,000 total hours

- 100+ hours in your current make/model of aircraft

- Certificate – Commercial or ATP

- Valid medical certificate

- No FAA violations

Coverage is still available if you don’t meet the above, but the best rate classes may not be.

Underwriting may change if you fly for certain foreign commercial airlines or fly planes with less than ten seats.

Cargo Pilots

Underwriting for cargo pilots (UPS, FedEx, etc.) follows the same rules as commercial pilots.

Here’s the bottom line – If you die while participating in private aviation, you can bet that the insurance company will look at your application and history to see if you misrepresented aviation.

If you did, there’s a good chance the insurance company may try to fight the claim, leaving your family in a tough situation.

Your best bet is to get the correct coverage now. Once you have more experience, we plan on re-shopping for a better rate.

Military Pilots

Life insurance is available for military pilots.

The coverage and underwriting ratings depend on the mission designation(s) and aircraft designation.

Some examples from Prudential include:

- Flat extra of $750 per every $100,000 of coverage for pilots and crew:

- Attack

- Bomber

- Fighter

- Multi-Mission

- Observation

- Anti-Submarine

If you are an instructor for any of the above, the flat extra would be $250 per $100,000.

Additional Military Details

Reserve and National Guard pilots and crew may obtain “standard” rates for the above if they fly less than 125 hours per year and are not on extended duty.

- Standard rates with no flat extra may be available for:

- Cargo/Transport

- Special Electronic Installation

- Search & Rescue

- Tanker

- Patrol

- Trainer

- Utility

- VIP

Before finalizing your rates, underwriting looks at your background, current status, deployment, etc.

Flat Extras and Aviation Exclusions: The Details

One of our goals when we work with you is to eliminate/minimize any potential flat extra expense.

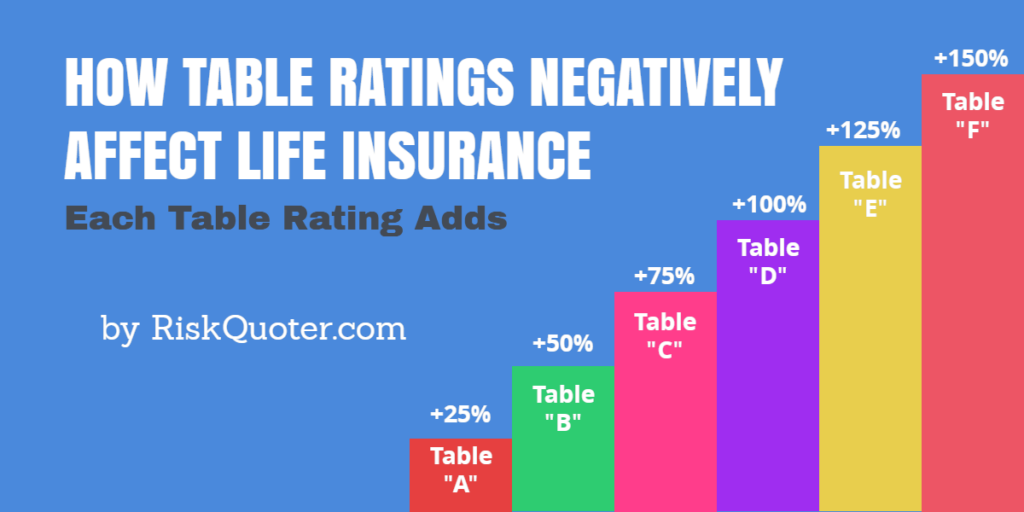

Flat extras are expensive, adding anywhere from $250 – $750 for every $100,000 of coverage you buy!

Exclusion

One of our other goals is to get you full life insurance coverage with aviation included.

Most life insurance policies will include coverage for private aviation unless you ask for an aviation exclusion rider.

Underwriting will add a flat extra expense to the policy for some applicants.

The flat extra expense may add $250 – $500 per every $100,000 coverage, based on your individual aviation experience.

As a result of the cost, some pilots may ask for an aviation exclusion rider (AER).

When a policy contains an aviation exclusion rider, your beneficiaries receive nothing if you die while piloting an aircraft.

Sometimes, we’ll write two policies, one with and one without the aviation exclusion rider…

This way, if something happens to you, at least a benefit will be paid out, and it helps lower your overall cost.

Insurance Companies May Require Exclusion for:

- Applicants under the age of 16

- Applicants over age 70-75 (varies w/ companies)

- Motor vehicle history of DUI/DWI.

- History of alcohol or substance abuse.

- Some medical conditions.

- Medical table ratings of 100% or greater.

- International flying.

If you’ve been denied life insurance due to a medical issue, let us know, as some companies are better than others with health conditions.

If you have one of the following conditions, it’s best to shop for companies for the health issue first, and then we can choose the best pilot company.

We generally advise against aviation exclusions unless there is no other option available.

Recent Articles:

Get the Best Life Insurance Table Rating for Your Situation

Top 10 Health Problems in America

Kidney Cancer Survivors – Life Insurance is Available!

If you’ve had kidney cancer and need life insurance, we can help you. Finding life…

Life Insurance for Throat Cancer Survivors

We specialize in high-risk life insurance underwriting for throat cancer survivors. While head and neck cancers…

How to Get Life Insurance after Colon Cancer

When you have colon cancer, the last thing on your mind is probably getting life…

Addison’s Disease Life Insurance

If you have Addison’s Disease and need life insurance, let us help you. Our life…

Aviation Occupations

We have life insurers if you make your living as a pilot or crew member for certain occupations.

The type of occupation you have may require a flat extra expense.

The chart below indicates how much is added to your rate for every $100,000 life insurance you buy.

| Occupation | Flat Extra Required? | Amount of Flat Per $100,000 of coverage |

|---|---|---|

| Corporate | Yes/No | Zero – $250 |

| Crop Dusting | Yes | $350 – $500 for planes built for this purpose. $500-$750 if plane is converted to this use. |

| Fire Fighting | Yes | $350 – $750 |

Whatever your occupation is, let us know the full details, and we’ll find you the best rates.

Comparing AOPA Insurance to Individual Options

You may wonder how our policies compare to the group life insurance policies offered by the Aircraft Owners and Pilots Association, better known as AOPA.

We offer pilots individual term life insurance and universal and whole life insurance.

You control an individual policy, whereas the administrators control a group policy.

AOPA offers three group life insurance products:

AOPA 50+ Term Group Life Insurance

- Available for ages 50-74

- Coverage amounts – $5,000 – $50,000

- Decreases to 50% at age 75, 25% at age 80

- Rates increase every five years

- No exam

- Accelerated death benefits

- No general aviation exclusion

- Convertible to a whole life plan

According to the AOPA website, “Proof of good health is required for coverage approval. This may or may not include a medical exam.”

Whatever your occupation is, let us know the full details, and we’ll find you the best rates.

AOPA Group Term Life Insurance Plan

- Available for under age 30 – under age 66

- Coverage amounts – $5,000 – $1,000,000

- Decreases by 50% at age 70, 75% at age 75

- Coverage terminates at age 80

- Tobacco and non-tobacco rates

- Premiums must be paid quarterly

- Accelerated death benefits

- No general aviation exclusion

- Convertible to whole life

Proof of good health is required.

AOPA Group Level Term Life Insurance

- 10-year group level term – age 20-66

- $50,000 – $1,000,000

- 20-year group level term – age 20-56

- $200,000 – $1,000,000

- Rates stay level for the term unless the entire group changes

- Three rate classes – Preferred, Select, and Standard

- Dependent children rider available

- Accelerated death benefits

- No general aviation exclusion

- Convertible to individual whole life

Group life insurance is inexpensive and simple when you’re younger, but you do not have control over the policy.

If you are considering group life, ask for the rate sheet for all ages to see your rate as you age.

You control an individual life insurance policy. You can choose the coverage amounts and term lengths and decide how long you want coverage.

As we’ll show you, most individual policies do not exclude aviation. They include accelerated benefits and other riders and offer conversion privileges.

FAQ

You have questions about life insurance for aviation, and we have the answers!

Final Thoughts

We offer a no-risk, no-obligation life insurance service.

We’ll provide quotes from top-rated life insurance companies specializing in aviation.

We have both options available for you if you want a policy with full coverage or if you want aviation excluded.

Please take a few minutes to submit your quote request. Thank you.