We help bladder cancer survivors find affordable coverage from life insurers specializing in high risk.

How Does Bladder Cancer Affect Life Insurance?

Most bladder cancers (95%) are transitional cell carcinomas (TCC) originating in the inner lining.

Other types of bladder cancer, such as adenocarcinoma and squamous cell carcinoma, are considered at higher risk than TCC.

The following underwriting guidelines apply to TCC bladder carcinoma.

The underwriting concern with bladder carcinomas has to do with the high rate of repeat cancer.

Life Insurance by Bladder Cancer Stage

There are many variables when it comes to bladder carcinoma underwriting.

The best way for us to help you is to gather your cancer history details and ask companies for feedback.

Stage Tis bladder cancer

Unlike most in situ cancers considered low-risk, in situ bladder cancers are high-risk tumors.

In situ, bladder carcinomas may be hard to spot and have a greater risk of becoming invasive bladder cancers.

For that reason, in situ bladder cancers typically require a 2-year postponement period after completion of treatment.

A 50% table rating and a flat extra (for up to 10 years) of $1,000 per every $100,000 coverage are common.

Stage Ta bladder cancer

Life insurance may be available as soon as you complete your follow-up testing.

As long as there were less than three tumors and none were greater than 3cm in size.

Standard rates and a flat extra expense are available if you meet these criteria.

The flat extra is temporary but would add $500-$750 for every $100,000 of coverage.

Flat extras typically last 3-4 years and then drop off.

Greater than three tumors or greater than 3 cm in size?

If this is the case, life insurers will postpone offering coverage for one year after completing follow-ups.

Standard rates with a flat extra of $600 – $750 per every $100,000 coverage is common at that time.

In this case, the flat extra would last for five years.

Stage 1 bladder cancer

The availability and price for stage 1 bladder carcinomas depend on:

- The number of tumors

- The size of the largest tumor in the bladder

- The cancer grade – low grade or high grade

- The number of occurrences

- Use of BCG as part of treatment

The best-case scenario for a low-grade bladder carcinoma is a one-year postponement.

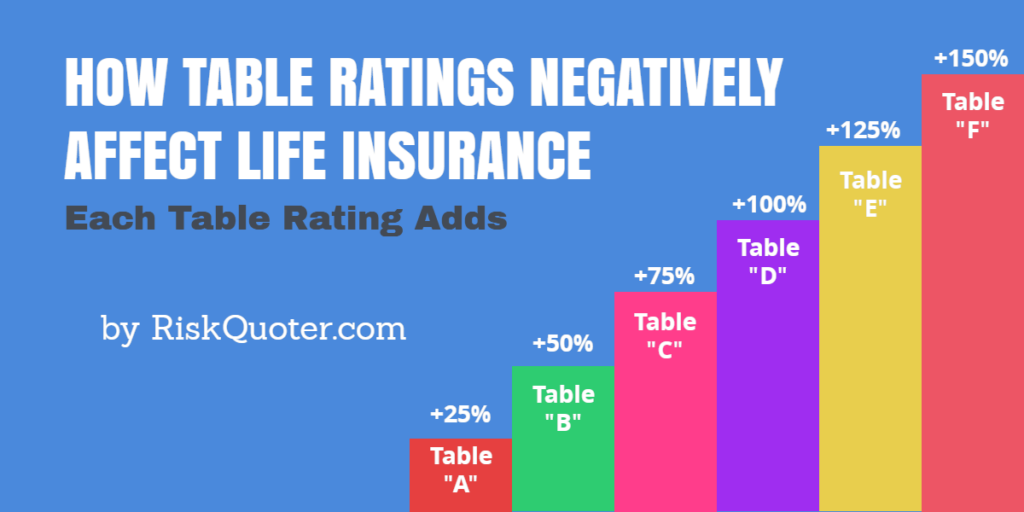

After the postponement, a 50% table rating and a flat extra (for five years) of $600-$750 per every $100,000 coverage are added.

Most high-grade bladder carcinomas will require a 2-year postpone period.

Once life insurance is available, a 50% table rating and a flat extra (for up to 10 years) of $1,000 per every $100,000 coverage.

The number of times you’ve been treated will impact underwriting and could result in companies declining you.

Stage 2 bladder cancers

Life insurers will most likely decline to offer life insurance to you unless you have completed a radical (total) cystectomy.

Once a total cystectomy has been completed, life insurers postpone coverage for 3-5 years from the surgery date.

When life insurance is available, standard rates with a 50% table rating are common.

Some insurance companies may add a flat extra expense of $1,000 for every $100,000 of coverage.

The duration of the flat extra would depend on your exact medical history.

Stage 3 and Stage 4 Bladder Cancer

Guaranteed-issue life insurance may be the only option available.

This type of policy is typically limited in coverage to approximately $25,000.

Accidental death benefit insurance is also available.

Bladder Cancer Underwriting Questions

Here’s what we need to know about your bladder cancer history:

- When were you diagnosed with bladder cancer?

- What stage was the bladder cancer?

- Were any lymph nodes positive for cancer?

- Was cancer a low-grade (well-differentiated) or high-grade (poorly differentiated) cancer?

- How was bladder cancer treated?

- Transurethral Resection (TURBT)

- Cystectomy – Partial or Radical

- Chemotherapy – Either intravesical (entered into the bladder) or systemic (injection or pill).

- If you had a TURBT, did you receive BCG or mitomycin after the TURBT?

- If yes, please include the start and completion dates.

- Has the bladder carcinoma recurred?

- How often do you visit your physician for follow-up testing?

- When were your last cystoscopy and urine cytology tests?

- What medications and dosages do you take?

- Are you a cigarette smoker?

- If you quit, when did you quit smoking?

- Have you had any other health issues in the past or present? If yes, please describe.

Final Words

We’ll work with you to find the best life insurance options today.

Once we receive feedback from life insurance companies, we’ll give you a range of pricing and what to expect from life insurance underwriting.

It is also important to know that life insurance rates may improve over time based on your health history.

Please take a few minutes to complete your quote request today.

Thank you.

Related Articles: