We specialize in high-risk life insurance underwriting for throat cancer survivors.

While head and neck cancers are complicated to underwrite, we’ll help you find your best options.

Throat cancers are typically categorized as either:

Laryngeal cancer (voicebox) or pharyngeal cancers of your throat’s upper, middle, or lower part.

While few companies offer coverage, the following article tells you what you need to know.

Throat Cancer Life Insurance Underwriting

Your doctor may perform laryngoscopy and take biopsy samples for evaluation.

The biopsy results and additional imaging tests (CT, MRI, PET, etc.) are completed.

The tests are done to determine the cancer stage and extent of cancer.

Throat Cancer Underwriting Questions

- When were you first diagnosed with Throat Cancer?

- Where was the primary location of cancer?

- What diagnostic tests were completed to diagnose cancer? (CT scan, MRI, PET scan, etc.)

- What Stage Was Your Throat Cancer? T1, T2, T3, etc.

- Did cancer spread to your lymph nodes, thyroid, etc?

- How was cancer treated?

- When did you start cancer treatment?

- When did you complete cancer treatment?

- Are you a smoker? If you quit, when did you quit?

- Has there been any recurrence?

With the above information, you’ll have underwriting feedback in 3-5 days from companies.

At that time, we’ll let you know what each company has to say regarding underwriting and price.

Life Insurance Options for Throat Cancer

Life insurers will postpone offering coverage to you for five years or longer.

Other options may be available in the interim.

Under Age 50 When Diagnosed – Accidental death insurance is available and guaranteed issue policies depending on your age.

Age 50 or Older – Guaranteed issue and accidental policies are available anytime.

Policies are limited to $25,000 or less, and the death benefit is graded.

Once term life insurance or universal life insurance is available,

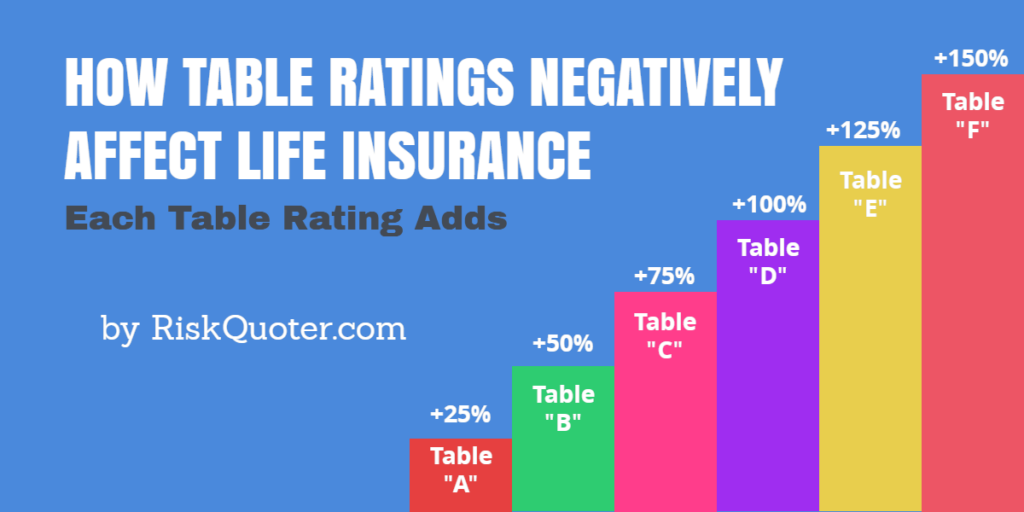

Most life insurance companies will offer you their standard life insurance rates plus an additional expense called a flat extra.

While flat extras are temporary (5 years for most),

The flat extra typically adds $500 – $1500 for every $100,000 coverage you seek.

The best way to get accurate underwriting feedback is to let us shop the market for you.

There is no obligation or pressure with our service.

We’ll reach out to companies for underwriting feedback.

Once we receive feedback, we’ll let you know what to expect regarding underwriting and price.

Please take a few minutes to complete your quote request today. Thank you.

Recent Articles: