Does life insurance cover COVID?

Yes, and we show you how to get approved!

COVID Overview

Several factors affect COVID-19 life insurance, including:

When COVID started in early 2020, life insurance companies responded quickly by:

- Tightening up underwriting criteria

- Suspending products

- Reducing the maximum issue age for policies

- Eliminating underwriting credits

Slowly we are just now starting to see improvements in underwriting high-risk conditions like COVID as we head into the new year.

We show you exactly what to expect from life insurance underwriting before you apply.

We help you work through the companies to ensure that you receive the best possible offer when available.

COVID Positive History

If you’ve been diagnosed with COVID-19, the general rules seem to be:

- 30 day postpone from date of full recovery

- 90 day postpone if you were hospitalized

If you’ve made a full recovery, underwriting COVID histories is not a problem.

We expect normal underwriting rules to return as the vaccine gets further distributed.

Exposure to COVID

If you’ve been exposed to someone with COVID, some companies will make you wait 30 days from the date of exposure.

How Medical Conditions Affect COVID Underwriting

Underwriters are looking at the following conditions when deciding whether to issue a policy to you.

- Brain Disorders

- Cancer History

- Diabetes and Endocrine Disorders

- Gastrointestinal Conditions

- Heart Conditions

- HIV+

- Respiratory Diseases

The above are the main categories we see negatively impacting underwriting, but there are other conditions as well.

Something to keep in mind is that the above doesn’t represent an automatic postpone or decline.

From our experience, most companies have really been trying to approve coverage on as many cases as possible.

Your Current Age and COVID

Some companies have suspended underwriting simply based on your age.

| Company | Age |

| AIG – American General | 70 |

| Global Atlantic | 70 |

| John Hancock | 80 |

| Lincoln National | 80 |

| Minnesota Life | 71 |

| New York Life | 80 |

| North American | 80 |

| Penn Mutual | 70 |

| Principal | 80 |

| Protective Life | 80 |

| Prudential | 80 |

| Symetra | 80 |

| Transamerica | 76 |

| United of Omaha | 70 |

International Travel During COVID

Life insurers look at recent travel, planned travel, and your destination.

The general consensus is that most companies will postpone you for 30 days after you return from your trip.

At that time, normal underwriting rules apply.

If you have an upcoming trip during the next 60 days, you may get postponed until you return, and then have to wait 30 days.

Life Insurer COVID Guidelines

These rules are starting to change more frequently so check back often.

AIG American General

- Statement of Health (PHS) required for all cases

- Covid positive is a postpone for 30 days after full recovery

- Postpone for 30 days for known exposure to Covid

- International travel is postponed for 30 days

- Temporary COVID guidelines

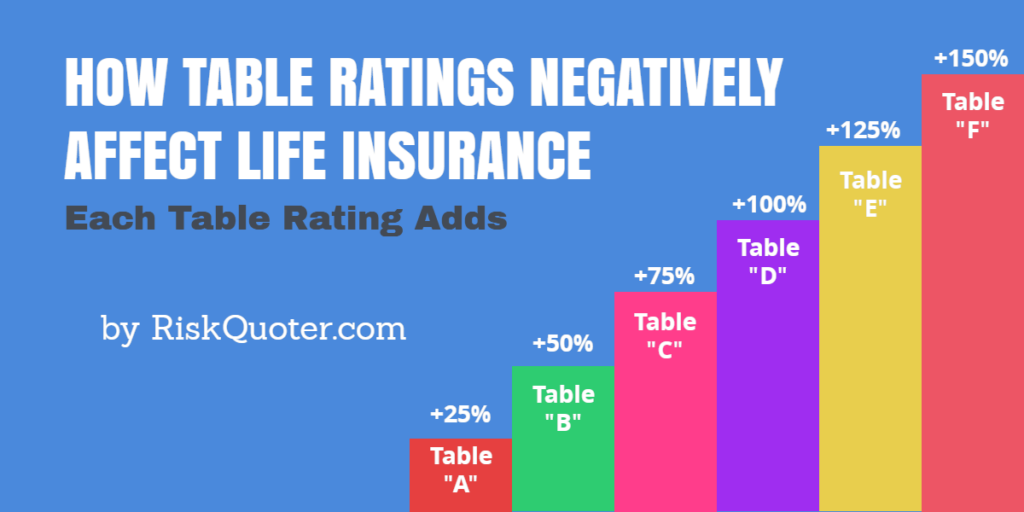

- Age 70+ all cases postponed

- 60-69 – all rated cases postponed

- 50-59 – Rated greater than Table B postponed

- Under Age 50 – Greater than Table D postponed

- Medical conditions such as CAD, metabolic disorders, respiratory impairments, underlying malignancies

Banner Life Insurance Company

- Good Health Statement all cases

- International travel is no longer an automatic postponement.

- Covid Positive – 30 day postpone after full recovery

- 55-64 – Underwriting Exceeds table 6 will be postponed

- 65-70 – Greater than table 4 is postponed

- Age 71+ Exceeds standard rate – postponed

- 6 month postpone on following chronic conditions

- Arrhythmia, atrial fib, anticoagulant use

- Coronary artery disease

- Stroke, TIA

- Diabetes

- Lung Disease – asthma, COPD, bronchitis, pneumonia

John Hancock

- Positive for COVID – minimum 30 day postpone period

- Updated Good Health Statement required for all cases

Lincoln National

- 65 and under and rated Table 5 or higher are postponed

- 66-79 rated Table 3 or higher postponed

- 80-85 – all cases postponed

- Accelerated Benefit Rider (ABR) – Age 70 or older rider is not available

- Declaration of Insurability Required on all cases. COVID must be disclosed and Lincoln will determine if it can continue with offer or postpone until full recovery.

- International travel – Level 3 country – indefinite postpone

- Positive Covid – 1 month postpone from full recovery.

- If hospitalized, postpone is 3 months from full recovery.

Penn Mutual Life Insurance

- Age 70 or older – All cases are postponed

- Any age – Underwriting greater than table 4 is postponed

- Table 4 to Standard program is suspended

- Survivorship whole life rate class upgrade is postponed

- Lifestyle credit program is out.

Principal

- International Travel – 30 day postpone

- Statement of Health on all cases

Protective Life

- 80 or older – all applications postponed

- 70-79 – Standard rating or better and no underlying medical condition

- 60-69 – Table 4 or better and no underlying medical condition.

- 0-59 – Will consider health impairments through table 4.

- Above Table 4 on a case by case basis.

- Significant underlying conditions include:

- Heart disease

- Significant cancer in past 10 years

- Diabetes

- Pulmonary disease – COPD, asthma etc.

- Autoimmune or Immunosuppressive disease

- Medications such as biologics, prednisone/steroids, methotrexate

- Statement of Health required for all cases

Prudential

- Age 80 or older – Not accepting any application

- Age 65 and over – Rating of Table D or higher is postponed

- Postponing any rated chronic respiratory condition

- Positive for COVID – Postpone for 30 days after full recovery.

Symetra

- Good Health Statement on all cases

- International travel – 30 day postpone

- International plans within next 60 days – postpone

- Covid positive – 30 day postpone after full recovery

- covid exposure – 30 day postpone

- Age 70 or older – Table 4 or greater – 90 day postpone

Final Words

Underwriting is rapidly changing.

A growing concern with underwriting relates to the long-haul COVID symptoms that survivors are facing.

It’s always best to try and get a policy now and improve on it in the future if possible.

Please take a few minutes to submit your quote request.

There is no pressure or obligation with our service. Thank you.

Recent Articles: